Benzinga - by Murtuza Merchant, Benzinga Staff Writer.

Bitcoin (CRYPTO: BTC) has dipped 2% to $65,500, but blockchain analytics firm Lookonchain believes the data suggests it might be a good time to buy, not sell.

In a series of tweets on Friday, Lookonchain outlined five key indicators suggesting Bitcoin may still have room to grow.

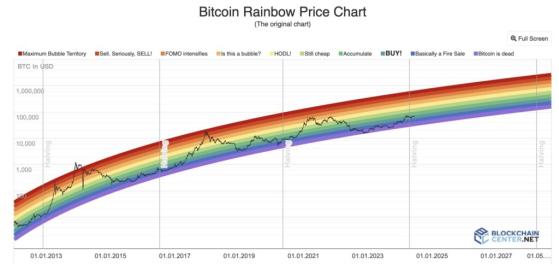

Rainbow Chart Signals Potential Upside

“The Rainbow Chart is a long-term valuation tool,” Lookonchain pointed out, “and it currently shows that now is still a good time to buy BTC.”

The Rainbow Chart uses a logarithmic growth curve to depict potential future price directions, and according to Lookonchain’s analysis, the current price point suggests Bitcoin is not yet overvalued.

RSI Hints At Further Growth

Lookonchain also examined the Relative Strength Index (RSI), a technical indicator used to measure price momentum.

While an RSI above 70 typically indicates an overbought asset, Lookonchain noted the current RSI for Bitcoin sits at 69.93.

Compared to historical data, they believe this suggests there’s room for further price increases before a potential correction.

Also Read: Paul Ryan Urges America To Embrace Stablecoins To Maintain Dollar Dominance

Moving Averages And On-Chain Data Paint Bullish Picture

Lookonchain delved further, analyzing the 200-week moving average and Cumulative Value Coin Days Destroyed (CVDD).

Both indicators, according to the firm, suggest the current price point is within a healthy range and hasn’t reached a historical peak, potentially signifying an opportunity for accumulation.

A Time For Strategic Investment?

Lookonchain’s final analysis focused on the 2-Year MA Multiplier, another technical indicator.

Their findings suggest the price of Bitcoin is currently positioned between historical bull and bear market zones.

This, the firm states, indicates the market hasn’t reached its peak and could be ripe for strategic investment.

Stay Updated On The Evolving Digital Asset Landscape

For those seeking to learn more about Bitcoin and other digital assets, Benzinga’s Future of Digital Assets conference on Nov. 19 offers a valuable opportunity to gain insights from industry leaders and navigate the ever-changing digital landscape.

Read Next: MicroStrategy Ups Convertible Note Offering To $700M To Fuel Bitcoin Acquisitions

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga