Benzinga - Major coins traded mixed on Monday evening as the global cryptocurrency market cap declined 0.3% to $1.2 trillion at the time of writing.

| Cryptocurrency | Gains +/- | Price (Recorded at 10:14 p.m. EDT) |

| Bitcoin (CRYPTO: BTC) | +0.13% | $29,128.82 |

| Ethereum (CRYPTO: ETH) | -0.73% | $1,825.19 |

| Dogecoin (CRYPTO: DOGE) | -2.27% | $0.073 |

What Happened: Bitcoin was seen trading marginally higher, while Ethereum was treading red at the time of publishing. The apex cryptocurrency lacked movement as it awaits regulatory clarity for a push beyond the sticky $30,000 level.

Top Gainers (24-Hours)

| Cryptocurrency | Gains +/- | Price (Recorded at 10:14 p.m. EDT) |

| Bitcoin Cash (BCH) | +6.59% | $236.68 |

| Hedera (HBAR) | +3.81% | $0.059 |

| Optimism (OP) | +3.08% | $1.78 |

Analyst Takes: OANDA Senior Market Analyst Edward Moya noted that the key macro driver for this week would be the Consumer Price Inflation report which would most likely show "moderate price growth."

The CPI report is due on Aug. 13, according to the schedule put out by the U.S. Bureau of Labor Statistics.

"US economy is still recession bound. As we get the last batch of earnings, so far 84% of the companies in the S&P 500 have provided results, around 80% have delivered topped market expectations," wrote Moya, in a note, seen by Benzinga.

Cryptocurrency trader, Michaël van de Poppe, noted that this year the largest asset manager in the world, BlackRock Inc, applied for a Bitcoin ETF. He questioned those who think that Bitcoin was headed to the $12,000 level.

In 2023, the largest asset manager applied for #Bitcoin ETF.In 2023, the largest fintech company launches a stablecoin.

Yet, you think #Bitcoin will go to $12,000.

Think again.

— Michaël van de Poppe (@CryptoMichNL) August 7, 2023

Even so, Van de Poppe acknowledged that it was a "boring time" when it came to price action. He said on X.com, formerly Twitter, "The time to sit on your hands, accumulate some more if you can, and just simply wait."

The Amsterdam-based trader said that people will be "bearish" in the first stage of the bull market.

"No need to evaluate everytime, as you’ll probably hear lots of bear / bull arguments."

It's the boring time.The time to sit on your hands, accumulate some more if you can, and just simply wait.

No need to evaluate everytime, as you'll probably hear lots of bear / bull arguments.

In the first stage of the bull, people will continue to be bearish.

— Michaël van de Poppe (@CryptoMichNL) August 7, 2023

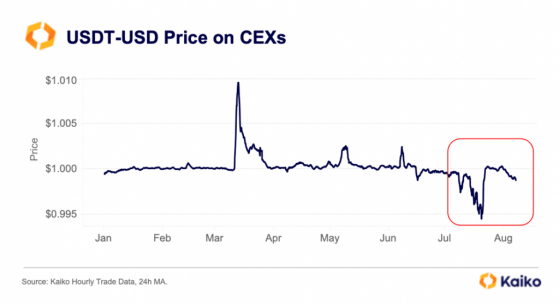

Meanwhile, Kaiko Research, said in a note that there was no clear indication why traders were "swapping out" of Tether (USDT).

Source: Kaiko Research

"Tether just reported massive Q2 revenues. Tether’s CTO suggested that the selling could be foul play and closely timed with Binance’s listing of the new stablecoin FDUSD on July 26th, issued by Hong Kong-based First Digital. However, there is no evidence that these two events are linked," said the cryptocurrency market data provider.

On Monday, cryptocurrency analyst Ali said on X that Chainlink whales have purchased 14 million LINK over the past week, which is worth more than $100 million.

#Chainlink whales have bought around 14 million $LINK over the past week, worth over $100 million! pic.twitter.com/WOexHbNCRA— Ali (@ali_charts) August 7, 2023

LINK prices rose 2.22% over 24 hours. So far this year, the token has shot up nearly 30%.

Photo Courtesy: Shutterstock.com

Read Next: Pro-XRP Lawyer Says He Expected Ripple Token To Break $1 After Court Ruling: ‘Until Bitcoin Breaks Its All-Time High…’

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI