Benzinga - by Shanthi Rexaline, Benzinga Editor.

President Joe Biden delved into one of the pressing issues that is weighing down against him, as he prepares for a re-run, potentially taking on his predecessor Donald Trump.

What Happened: When Biden was reminded of all the weak numbers about the economy under him and asked whether he worried about running out of time to turn things around, the president refuted the claims of gloom and doom.

“We’ve already turned it around,” said Biden in an exclusive interview with CNN’s Erin Burnett that was aired on Wednesday.

Referring to the University of Michigan’s survey, the president said 65% of the American people think they were in good shape economically. “They think the nation is not in good shape. They’re personally in good shape. The polling data has been wrong all along,” he said.

Biden touted the labor market strength as evidence of his success on the economic front. He noted that his administration has been able to create more jobs. “We’ve made more in a situation where people have access to good-paying jobs,” he said.

The president did agree that there is more to be done. “And the last I saw, the combination of the inflation, the cost of inflation, all those things, that’s really worrisome to people with good reason,” he said.

“That’s why I’m working very hard to bring the cost of rentals down, to increase the number of homes that are available.”

The economy, however, has improved significantly during his tenure, the president said. He noted that when he took over there were fears that the economy was going to collapse. “We have the strongest economy in the world. We say it again in the world,” he said.

When the host said first-quarter GDP released in late April fell short of expectations, Biden said the response of the markets to the data was overwhelmingly positive. It is to be noted here that the market has been reacting to every piece of weak economic data with a move to the upside on expectations that the Fed will be forced to lower rates.

Biden also sort of cemented expectations of a rate cut. “And one of the reasons why people feel good about it not being strong as before is they believe that the Fed’s going to respond,” he said.

“No president has had the run we’ve had in terms of creating jobs and bringing down inflation,” Biden said, adding that it was 9% when he took office. “People have a right to be concerned, ordinary people. The idea that you bounce a check, you get a $30 fee for bouncing the check. I changed that. You can’t charge more than eight bucks for that,” he said.

“There’s corporate greed going on out there and it’s got to be dealt with,” the president said. He also referred to shrinkflation, saying “They did a thing that’s like 20% less for the same price.”

That’s is corporate greed, and we’ve got to deal with it and that’s what I’m working on,” Biden said.

Why It’s Important: The president’s comments come at a time when he is raking very low on his job approval. Biden had a 38.7% average job approval rating in his 13th quarter in office, the lowest among the nine past presidents elected to their first terms, results of Gallup’s poll made public in late April showed.

Survey results of an FT-Michigan Ross poll published in mid-March showed that voters' approval rating for Biden's handling of the economy remained stagnant at 36%. When respondents were asked to choose between Trump and Biden for better handling of the economy, 40% said they trusted the former, compared to 34% who chose Biden.

Biden’s claims about a strong labor market may not be way off. Despite the economic uncertainty, the U.S. economy continued to add jobs at a robust pace. In fact, it is one of the reasons that has kept the central bank from considering rate cuts.

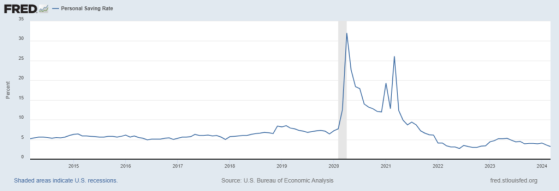

Overall, GDP growth also rebounded strongly in 2023, thanks to the resilient consumers. That said, consumers are seen dipping into personal savings, which are languishing at multi-year lows, and they are also living off credit.

Source: St. Louis Fed

The president’s claim of a hot inflationary environment at the start of his tenure might have been slightly off the mark. Inflation shot up and peaked at over 9% in August 2022 and the spike was due to the stimulatory measures announced to support the economy that ailed from the after-effects of the COVID-19 pandemic.

The SPDR S&P 500 ETF Trust (NYSE:SPY), an exchange-traded fund that tracks the broader S&P 500 Index, fell 0.16% to $516.37, according to Benzinga Pro data. Since Biden assumed office, the ETF is up over 66%.

Read Next: Jobs Growth Slows, Unemployment Ticks Up, Wage Increase Cools: ‘The Market Should Love This Report’

Image via photos on Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga