Benzinga - by Piero Cingari, Benzinga Staff Writer.

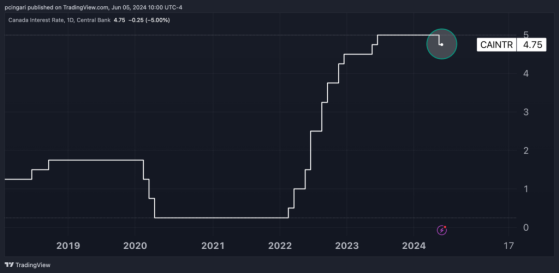

The Bank of Canada announced on Wednesday a 25 basis point reduction in interest rates, marking the first cut since March 2020, as widely anticipated by market participants.

Consequently, the benchmark overnight rate and the deposit rate have been lowered to 4.75%, while the Bank Rate is now at 5%.

The decision to lower rates stems from evidence indicating that underlying inflation is easing. The Governing Council concluded that monetary policy “no longer needs to be restrictive,” leading to a 25 basis point reduction in interest rates.

Policymakers noted that Canada’s economic growth was slower than expected in the first quarter, primarily due to weaker inventory investment affecting overall activity.

Labor market data indicates that businesses continue to hire, although the rate of employment growth has not kept pace with the growth of the working-age population.

In April, the annual inflation rate further decreased to 2.7%. The Bank’s preferred measures of core inflation also showed a slowdown, with three-month measures indicating a continued downward trend.

“Recent data has increased our confidence that inflation will continue to move towards the 2% target,” the Bank of Canada stated. “However, shelter price inflation remains high,” policymakers added.

Regarding forward guidance, the central bank is closely monitoring core inflation trends and is particularly focused on the balance between supply and demand in the economy, inflation expectations, wage growth, and corporate pricing behavior. The Bank remains committed to restoring price stability for Canadians.

Chart: Bank of Canada Cuts Interest Rates To 4.75% In June 2024

Market Reactions: The iShares MSCI Canada Index Fund (NYSE:EWC), which includes 94 Canadian stocks, experienced a 0.4% increase shortly after the interest rate decision was announced.

The top performers within the fund were GFL Environmental Inc. (NYSE:GFL), First Quantum Minerals Ltd. (OTCPK: FQVLF), and Ivanhoe Mines Ltd. (OTCPK: IVPAF), with gains of 4%, 2.4%, and 2.3%, respectively.

Meanwhile, the Canadian dollar, or Loonie, weakened by 0.3% against the U.S. dollar, crossing the 1.37 level per USD.

Read now: 152,000 New Jobs Added In May, Missing Expectations: ‘Notable Pockets Of Weakness’

Photo: JHVEPhoto/Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga