By Jonathan Stempel

NEW YORK (Reuters) - A federal judge on Wednesday said a former star Lehman Brothers Holdings Inc trader was not entitled to an $83 million (£64.4 million) bonus he claimed he was owed following the investment bank's 2008 collapse, on top of a similar sum that Barclays Plc (L:BARC) already paid him.

U.S. District Judge Lorna Schofield in Manhattan also said the former trader Jonathan Hoffman did not deserve $7.7 million that a federal bankruptcy judge had said he could recoup from the estate of Lehman's brokerage unit, Lehman Brothers Inc, based on an unpaid instalment from his 2007 bonus.

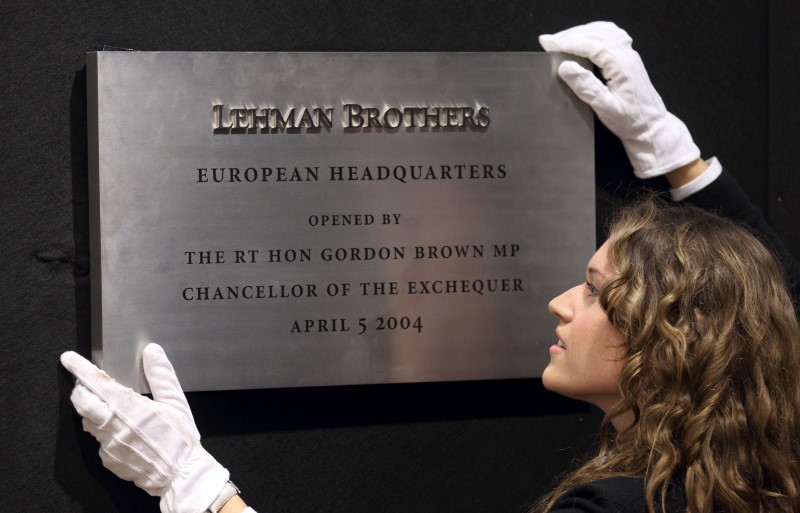

Hoffman's quest for additional pay is one of the largest lawsuits left in the wind-down of Lehman, whose Sept. 15, 2008 bankruptcy remains the biggest in U.S. history and helped trigger a global financial crisis.

Schofield said Hoffman, a former managing director, had been "extremely successful" trading interest rate products, generating billions of dollars of profit since joining Lehman in 1994.

But she said it "strains credulity" for Hoffman to argue that Barclays, the British bank that bought much of Lehman's North American banking business, paid him $83 million as a signing bonus or motivational tool, and that the sum only coincidentally matched what Lehman owed.

"He negotiated for and received everything he was owed, and now seeks to collect an $83 million windfall," Schofield wrote. "His claim is barred in its entirety."

Lawyers for Hoffman did not immediately respond to requests for comment.

A spokesman for James Giddens, a court-appointed trustee liquidating the Lehman brokerage estate, said the decision ensures that there will be no "double recoveries," an outcome that is fair to customers and creditors.

Hoffman had sought a payment equal to roughly one-seventh of the $540 million of profit he claimed to generate for Lehman in its 2008 fiscal year, prior to the firm's failure.

The judge said that payment obligation, however, had moved to Barclays.

Schofield's denial of the $7.7 million payment reversed part of an Oct. 2015 ruling in which U.S. Bankruptcy Judge Shelley Chapman in Manhattan also rejected an $83 million payout.

The case is In re: Lehman Brothers Inc, U.S. District Court, Southern District of New York, No. 15-08903.