Benzinga - Joe Brusuelas is chief economist and principal at RSM US LLP, a provider of assurance, tax and consulting services focused on the middle market. This article first appeared on RSM’s The Real Economy Blog.

The common thread between the inflation reports for January was a reacceleration in service-based inflation that is proving sticky and is not likely to abate enough for the Federal Reserve to pull back on interest rate increases. For this reason, we are changing our call on the path of monetary policy.

We now expect at least three 25 basis-point hikes at the Fed’s next three meetings.

This implies that the first point at which the Fed could pause its price stability campaign would be in the second half of this year. These increases also mean that the near-term policy peak will move higher than the current 5% to 5.25%.

With swap rates pricing in this move, market expectations are now in alignment with the general direction of policy, which is constructive.

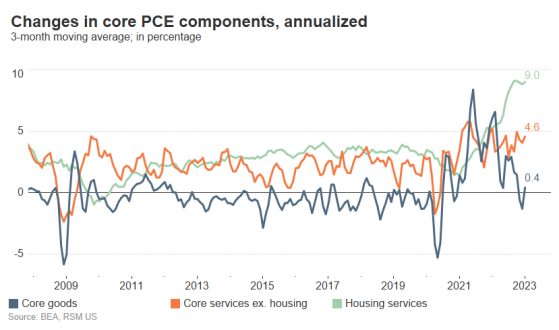

The Fed’s preferred metric of inflation at this point — the so-called supercore, or personal consumption expenditures core services index excluding housing —stands at 4.6% through January.

That level reflects our baseline estimation that inflation is moving between 4% and 5% and will prove difficult to move down to near the Fed’s 2% inflation target anytime soon.

It is quite clear that the American economy is proceeding through a supply side-induced structural change both in the labor market and global trade.

The broad decoupling of the G-7 economies from China because of geopolitical and economic tensions, as well as long-term demographic changes that curtail the supply of labor, will result in elevated inflation requiring a higher policy rate for longer than is commonly acknowledged.

The shocks unleashed by the pandemic and long-simmering global economic and security tensions are causing changes that are only now coming into view. This will require new policy frameworks.

We have made the case for some time that the Fed will officially adopt a higher inflation target, most likely at or above 3%, well after it has operationally abandoned the current 2% target.

Returning the economy to a 2% inflation trend will require far too much carnage in terms of a recession, lost jobs and reductions in productivity-enhancing fixed business investment.

The data flow and underlying trend in inflation in our estimation foreshadow those changes to come.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga