Investing.com - The markets have corrected in recent weeks, with the results season bringing as many good surprises as bad. This is a favourable environment for investors who know how to handpick the best stocks, to take profits on those that have risen (too much), and to buy at low prices those that have been unfairly punished.

However, to do this job, advanced tools and knowledge are usually essential. You need professional tools for sorting all the stocks on the market according to a host of complex financial criteria, as well as the ability to analyse and interpret each company's financial metrics in order to spot inefficiencies, not forgetting to take account of the trend in share prices on the charts.

- ⚠️PROMOTION SPECIAL! Take advantage of InvestingPro's high-performance AI tools and strategies for just 7 pounds per month thanks to a limited-time discount on the 1-year Pro subscription! CLICK HERE to take advantage before it's too late, and know which stocks to buy and which to shun whatever the market conditions!⚠️

In short, investing with the aim of achieving well above-average returns is a profession in its own right, requiring solid skills and specialised tools.

However, the progress of artificial intelligence is solving the problem, by providing individual investors with turnkey tools that enable them to know which shares to buy and which to sell on the basis of very concrete criteria.

Artificial Intelligence is here to help investors build portfolios that outperform effortlessly!

Ever since its creation, Investing.com has been committed to democratising investment and providing all investors with the tools they need to compete with the professionals, and has taken part in this revolution by developing ProPicks AI, available to all InvestingPro subscribers.

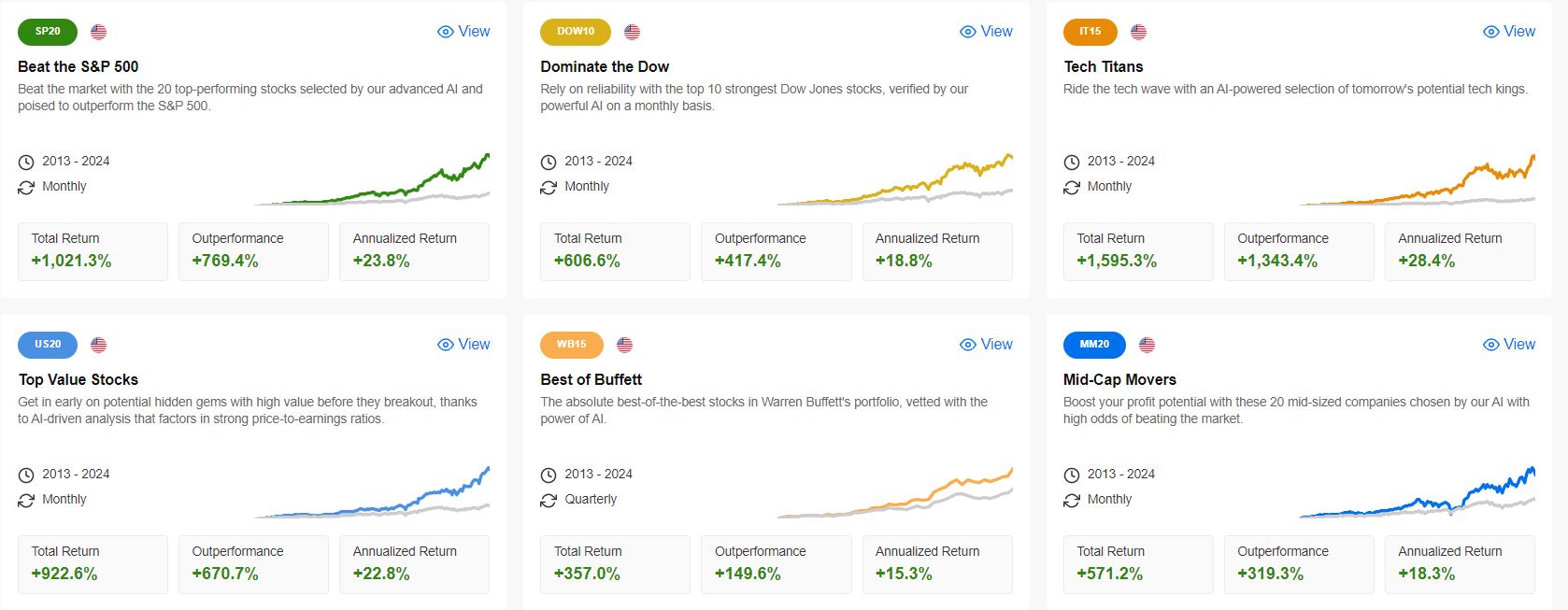

We've trained this AI using a wealth of financial data from the InvestingPro fundamental analysis platform. It's in charge of managing the 6 ProPicks thematic portfolios.

These portfolios consistently outperform benchmark indices over the long term. Each month, they're revalued based on the closing price on the first trading day. This revaluation for May occurred yesterday.

May's revaluation was particularly dense, as our AI was able to take into account the most recent financial data for the many companies that published their Q1 results.

- The "Beat the S&P 500" strategy, which has returned 1021.3% since 2013, bought 10 stocks and sold 10 stocks.

- The "Dominate the Dow" strategy, which has returned 606.6% since 2013, bought 4 shares and sold 4.

- The "Tech Titans" strategy, which has gained 1,595.3% since 2013, has bought 7 shares and sold 6.

- The "Best Value Stocks" strategy, which has gained 922.6% since 2013, bought 13 stocks and sold 13.

- The "Mid Cap Top 100" strategy, which has gained 571.2% since 2013, bought 14 shares and sold 14 shares

- The "Buffett's Best" strategy has not been revalued, as it adopts a quarterly revaluation.

In other words, the ProPicks portfolios have undergone a major revaluation that could position them ideally for an explosive month of May!

If you are already an InvestingPro subscriber, you can consult the list of stocks in each portfolio by clicking here.

If you're not already an InvestingPro subscriber, now is the perfect time to do so, not only because the ProPicks have just been revalued, but also because we are currently offering a limited-time discount enabling you to enjoy InvestingPro for just 8.1 euros per month as part of the annual subscription.

- Click here to take advantage of the special discount on the 1-year Pro subscription (7 pounds per month)

- Or click here to take advantage of the special discount on the 2-year Pro subscription (6.5 euros per month, that's less than 1.6 pounds per week!)

You can also click here to find out more about InvestingPro and compare the Pro and Pro+ subscriptions in more detail. You'll also be able to take advantage of a -10% discount, but you'll need to enter the promo code "ACTUPRO" manually in the dedicated space at the last stage before payment.