Benzinga - Thursday’s market session has showcased intriguing twists that caught the attention of keen investors and that could potentially signal a narrative shift.

Tech giants, typically at the forefront of market gains, faced a sudden downturn, while the Dow Jones Industrial Average continued to shine with an impressive winning streak.

The intriguing charts below capture three crucial price moves that are sure to pique the interest of investors.

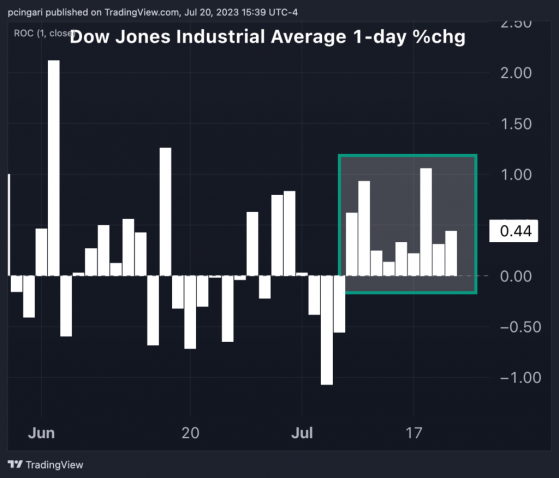

Chart 1: Dow Jones Marks 9 Consecutive Green Sessions

Blue-chip stocks seem to be the new meme stocks of the moment. The Dow Jones Industrial Average, represented by the SPDR Dow Jones Industrial Average ETF (NYSE:DIA), ended Thursday with its ninth consecutive session in the green.

This impressive positive streak hasn’t been witnessed since September 2017, when the Dow closed the year with a remarkable 25% total return.

Read also: Dow Jones Officially In Bull Market: Top 5 High-Dividend Stock Plays For 2023

Chart 2: Nasdaq’s Worst Day Of The Year

Early warning signs emerged from the tech world after Netflix Inc. (NASDAQ:NFLX)’s and Tesla, Inc. (NASDAQ:TSLA)’s second-quarter results disappointed investors.

The Nasdaq 100 Index, representing the 100 largest tech stocks and faithfully mirrored by the Invesco QQQ Trust (NYSE:QQQ), experienced a sharp daily decline of 2.5%.

The session marked the Nasdaq 100 Index’s worst performance in 2023. The decline of the index was mostly attributable to the sharp drops recorded by large tech stocks.

Apple Inc. (NASDAQ:AAPL), fell 1%, Microsoft Corp. (NASDAQ:MSFT), by 2.3%, Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL), by 2.6%, Amazon Inc. (NASDAQ:AMZN), by 4%, Meta Platforms Inc. (NASDAQ:META), by 4.3%, NVIDIA Corp. (NASDAQ:NVDA), by 3.3%, Netflix by 8.4% and Tesla by 9.7%.

Chart 3: Second-Worst Day Of The Year For AI Stocks

While investors have become accustomed to periods of increased volatility in technology stocks over the years, the worst trading session for artificial intelligence (AI)-related stocks is startling.

One of the most popular ETFs investing in AI-driven equities, the Global X Artificial Intelligence & Technology ETF (NASDAQ:AIQ), fell 2.7% in a single day, marking its second-worst performance since the start of the year.

Is the bullish AI trend losing steam, following the AIQ ETF’s impressive 40% surge since the beginning of the year?

It’s still too early to determine, but the upcoming sessions will undoubtedly play a crucial role in understanding how the market mood will evolve from here.

Read now: Fed Meeting Preview: Interest Rates Expected To Surge To 22-Year Highs, But Communication On Future Steps Is Key

Photo via Pixabay.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.