Benzinga - by Zaheer Anwari, Benzinga Contributor.

- A major technology ETF is set to undergo a significant rebalance, increasing its Nvidia holdings from 6% to 21%.

- This strategic reallocation will involve purchasing approximately $11 billion worth of Nvidia shares.

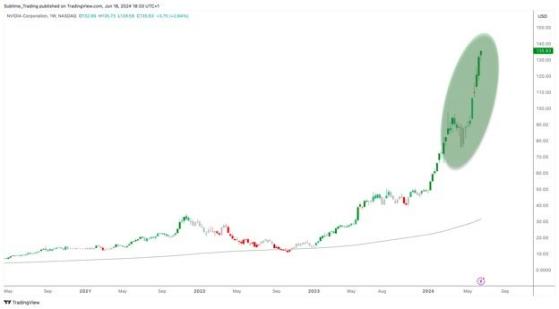

Nvidia’s share in the ETF will jump to around 21% from just 6%. This increase reflects Nvidia’s strong performance in the stock market, with a remarkable 164% growth year-to-date.

The rise in Nvidia's stock is due to solid earnings and positive market sentiment, making it a more influential part of the ETF’s portfolio.

On the other hand, Apple, which has been a key component of the ETF, will see its share cut drastically to about 4.5%, down from 22%.

This reduction is part of a broader adjustment within the ETF to balance out past overrepresentation and better reflect the current tech market.

The financial impact of these changes is significant, involving the acquisition of around $11 billion in Nvidia shares and the sale of about $12 billion in Apple shares.

This massive reallocation is expected to generate billions of dollars in trading volume, marking one of the most notable trading events in recent ETF history.

Since Nvidia's stock split last week, the company has seen an additional 7% rise in its stock price, showing continued investor confidence and market momentum.

However, with the stock climbing 37% since its earnings announcement on May 23, there is growing anticipation of a market correction.

Such a strong upward trend often leads to pullbacks as investors take profits, indicating potential volatility ahead.

Nvidia’s current technical indicators suggest the daily 20 simple moving average at $115 could be the first level of support, with the next significant support level likely around the $100 level, which is a psychological support zone.

After the closing bell on Monday, June 17, the stock closed at $130.98, trading down by 0.67%.

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga