Benzinga - by Zacks, Benzinga Contributor.

The cryptocurrency market had a solid 2023 and the rally is continuing this year. On Mar 14, the largest cryptocurrency, Bitcoin (CRYPTO: BTC), recorded an all-time high of 73,750.07. However, it has fallen more than 6.6% thereafter. Even then, Bitcoin has gained more than 67% in the first quarter after jumping 157% in 2023.

Moreover, the next Bitcoin halving is expected to occur in the third week of April 2024. When this occurs, the reward for mining new blocks is halved, making it more challenging for miners to earn net Bitcoins. Historically, this event has led to increased scarcity and has driven up the value of Bitcoin due to reduced supply.

Optimistic Estimates Several research firms have said that this is just the beginning of the Bitcoin rally. Standard Chartered expects Bitcoin will reach $100,000 by the end of 2024. Research firm Fundstrat has provided a target range of $116,000 to $137,000 for this year. Hedge fund SkyBridge predicts $170,000 by April 2025.

Furthermore, VanEck estimated a medium-term target of $350,000 for Bitcoin. Connors's firm has estimated that the base case Bitcoin will reach $110,000 in 2024 and $140,000 next year. However, according to the firm's best-case scenario, the cryptocurrency will hit $180,000 in 2024 and $450,000 in 2025.

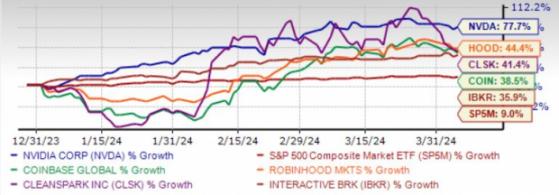

Our Top Picks We have narrowed our search to five bitcoin-oriented stocks that have strong potential for 2024. Each of our picks carries either a Zacks Rank #1 (Strong Buy) or 2 (Buy).

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

NVIDIA Corp. (NASDAQ: NVDA) is a semiconductor industry giant and one of the biggest success stories of 2023. As a leading designer of graphic processing units (GPUs), the NVDA stock usually soars on a booming crypto market. This is because GPUs are pivotal to data centers, artificial intelligence, and the creation of crypto assets.

Zacks Rank #1 NVIDIA's expected earnings growth rate for the current year is 84% (ending January 2025). The Zacks Consensus Estimate for its current-year earnings has improved 2.7% over the last 30 days.

Coinbase Global Inc. (NASDAQ: COIN) provides financial infrastructure and technology for the crypto economy in the United States and internationally. COIN offers the primary financial account in the crypto space for consumers, a marketplace with a pool of liquidity for transacting in crypto assets for institutions; and technology and services that enable developers to build crypto-based applications and securely accept crypto assets as payment.

Zacks Rank #1 Coinbase Global has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 23.8% over the last seven days.

Robinhood Markets Inc. (NASDAQ: HOOD) operates a financial services platform in the United States. Its platform allows users to invest in stocks, exchange-traded funds, options, gold, and cryptocurrencies. HOOD buys and sells Bitcoin, Ethereum (CRYPTO: ETH), Dogecoin, and other cryptocurrencies using its Robinhood Crypto platform.

Zacks Rank #2 Robinhood Markets has an expected earnings growth rate of more than 100% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 8.7% over the last seven days.

CleanSpark Inc. (NASDAQ: CLSK) operates as a Bitcoin miner in the Americas. CLSK owns and operates data centers that primarily run on low-carbon power. CLSK's infrastructure supports Bitcoin, a digital commodity and a tool for financial independence and inclusion.

Zacks Rank #2 CleanSpark has an expected earnings growth rate of 89.2% for the current year (ending September 2024). The Zacks Consensus Estimate for current-year earnings has improved more than 100% over the last 60 days.

Interactive Brokers Group Inc. (NASDAQ: IBKR) is a global automated electronic broker. IBKR executes, processes and trades in cryptocurrencies. IBKR's commodities futures trading desk also offers customers a chance to trade cryptocurrency futures.

Zacks Rank #2 Interactive Brokers Group has an expected earnings growth rate of 7.1% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 1.5% over the last seven days.

To read this article on Zacks.com click here.