Benzinga - by Zacks, Benzinga Contributor.

Players operating within the Zacks Computer – Integrated Systems industry, including International Business Machines (NYSE: IBM), Hewlett Packard Enterprise (NYSE: HPE), Agilysys (NASDAQ: AGYS) and PAR Technology (NYSE: PAR), are reaping the benefits of several favorable industry trends like advancements in data management capabilities, a rapid shift away from traditional siloed systems toward more integrated deployment techniques and heightened demand for modern application development approaches. However, the industry is still recovering from significant headwinds stemming from persistent supply chain bottlenecks, a challenging macroeconomic climate characterized by rising inflation and higher interest rates, soaring prices for key inputs and delays in customer acceptance of new products and services. These factors have resulted in significant order backlogs across the industry, casting a shadow on its prospects.

Industry Description

The Zacks Computer - Integrated Systems industry comprises companies that deliver advanced information technology solutions spanning computer systems, software platforms, data storage infrastructure and microelectronics. These industry players are ramping up investments in data modernization and analytics, cybersecurity and threat defense, remote work enablement, process automation, contactless service delivery models, enhanced customer and employee experience offerings and supply chain modernization initiatives, which are aimed at accelerating digital transformation services for their enterprise customers. Some players provide technological solutions (products and services) to help organizations connect, interact and transact with customers. Others develop and market information recognition, data entry software, systems and technologies.

4 Computer - Integrated Systems Industry Trends in Focus

Integrated Solutions Driving Demand: The industry is experiencing a surge in demand for integrated solutions across enterprises of all scales, driven by increasing investments in cutting-edge software technologies such as the Internet of Things (IoT), big data analytics, artificial intelligence and blockchain. This demand is further fueled by the significant opportunities presented by business analytics, cloud computing, mobile technologies, security solutions and social business platforms. Additionally, industry players are anticipated to benefit from the recovering global IT spending, as predicted by Gartner, enabling them to capitalize on the rising demand for comprehensive and seamless integrated solutions that can streamline operations and enhance productivity across various sectors.

Solid Adoption of Multi-Cloud Model: The industry is witnessing the robust adoption of the multi-cloud model, as enterprises seek to achieve better scalability and optimize resource utilization. This trend is expanding the scope of industry participants, enabling them to leverage the benefits of cloud and hardware/software virtual technologies, which are anticipated to favor the industry's growth. Moreover, as growth and investment opportunities in developed countries continue to slow down, emerging economies are poised to play a crucial role in driving the industry's future. The multi-cloud model's increasing popularity, coupled with the favorable tailwinds from cloud and virtual technologies, and the potential of emerging markets, presents a strong foundation for industry participants to capitalize on new opportunities and foster sustained growth.

Supply-Chain Bottlenecks and Backlogs: Industry participants are grappling with a multitude of challenges, including supply constraints, softening demand for servers and cognitive applications, as well as delays in customer acceptance. These factors have contributed to consistent backlog levels, particularly in the Compute, High-Performance Computing & Mass Storage Class and Storage segments. Furthermore, the industry's outlook is affected by the volatility in foreign exchange rates, primarily due to the prevailing macroeconomic scenario and headwinds in emerging markets.

Semiconductor Chip Shortage Mars Prospects: The industry is grappling with the ripple effects of the ongoing semiconductor chip shortage, which has posed significant challenges for participants. The time-consuming business model transition to cloud computing has compounded these difficulties, requiring companies to navigate complex operational shifts amidst supply chain disruptions. Moreover, the prospects of industry players are further dampened by lower spending across Data-Center Systems, primarily driven by component shortages, particularly in memory and CPUs, as well as a deceleration in hyperscale spending.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Computer – Integrated Systems industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #77, which places it in the top 31% of more than 250 Zacks industries.

The group's Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates outperformance in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

The industry's position in the top 50% of the Zacks-ranked industries is a result of a positive earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are optimistic about this group's earnings growth potential.

Before we present a few stocks that you may want to consider for your portfolio, let's take a look at the industry's recent stock-market performance and valuation picture.

Industry Lags Sector & S&P 500

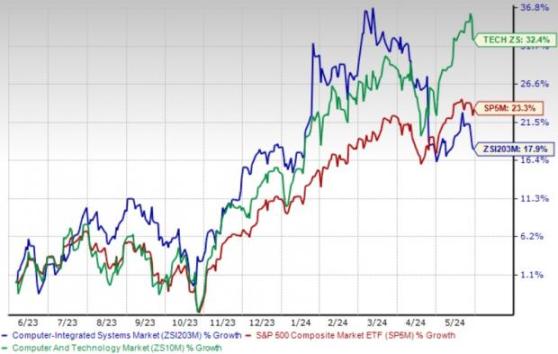

The Zacks Computer – Integrated Systems industry has underperformed the broader Computer and Technology sector and the Zacks S&P 500 composite in the past year.

The industry has returned 17.9% over this period compared with the S&P 500 and the broader Computer and Technology sector's respective returns of 23.3% and 32.4%.

One-Year Price Performance

Industry's Current Valuation

On the basis of the trailing 12-month P/S, which is a commonly used multiple for valuing computer-integrated systems stocks, we see that the industry is currently trading at 1.82X compared with the S&P 500's 4.04X. It is also below the sector's trailing 12-month P/S of 5.25X.

Over the past five years, the industry has traded as high as 2.15X and as low as 1.14X, with the median being at 1.62X, as the chart below shows.

Trailing 12-Month Price-to-Sales (P/S) Ratio

4 Computer-Integrated Systems Providers to Watch

PAR Technology: This Zacks Rank #2 (Buy) company designs, develops, manufactures, markets, installs, and services microprocessor-based transaction processing systems for the restaurant and industrial marketplaces, including Corneal Topography systems for measuring the true topography of the eye and vision inspection systems for the food-processing industry (Commercial Segment). PAR is also engaged in the design and implementation of advanced-technology computer software systems for the Department of Defense and other government agencies.

PAR has attained a position of market leadership among cloud-based restaurant management Software as a Service providers. The company's software business, Brink, is growing quickly and its restaurant cloud-based Point of Sale software is deployed at more than 1,000 restaurants.

PAR Technology has acquired TASK Group and Stuzo Holdings to expand its unified commerce software offerings. These acquisitions will expand the global food service technology company's offerings into convenience stores, fuel retailers and international markets

With over 110 Enterprise customers in 70 countries, TASK will immediately expand PAR's international exposure with its all-in-one unified platform. TASK already lists multiple marquee brands as customers, including McDonald's and Starbucks, and the acquisition will also allow PAR to cross-sell international expansion to its domestic customer base and more effectively target new international logos.

PAR Technology has completed its acquisition of Stuzo Holdings, which provides digital engagement software to convenience and fuel retailers. This acquisition extends PAR Technology's reach to 25,000 convenience store sites.

The Zacks Consensus Estimate for the company's 2024 loss has become narrower from 75 cents per share to a loss of 65 cents per share over the past 30 days. PAR's shares have risen 2.5% year to date.

Price & Consensus: PAR

International Business Machines: This Zacks Rank #3 (Hold) company is witnessing solid net sales growth in the software segment driven by healthy hybrid cloud adoption and solid demand trends across RedHat, automation, data in AI and security.

A strong foundation of research and innovation, a broad portfolio that caters to various industry requirements and a diverse global market presence set it apart from its competitors. IBM had announced more than 10 acquisitions in the past year, including a $2.13 billion deal to acquire Software AG's iPaaS (integration platform-as-a-service) businesses.

IBM entered into a definitive agreement to acquire HashiCorp for $35 per share in cash, representing an enterprise value of $6.4 billion. The transaction is expected to close by the end of 2024. HashiCorp's suite of products provides enterprises with extensive Infrastructure Lifecycle Management and Security Lifecycle Management capabilities to enable organizations to automate their hybrid and multi-cloud environments. HashiCorp's offerings have widescale adoption in the developer community and are used by 85% of the Fortune 500.

The acquisition of HashiCorp by IBM creates a comprehensive end-to-end hybrid cloud platform built for AI-driven complexity. The combination of each company's portfolio and talent will deliver clients extensive application, infrastructure and security lifecycle management capabilities. The Qiskit Runtime Service simplifies the execution of quantum circuits, while the Qiskit Code Assistant, powered by watsonx-based generative AI models, automates the development of quantum code.

Increased watsonx adoption by clients is a tailwind. The watsonx Code Assistant enables developers and IT operators to code more quickly and precisely with the assistance of generative AI. The usage of natural language ensures developers from various skill sets have access to automation across business operations

The Zacks Consensus Estimate for its 2024 earnings has moved south by a penny to $9.91 per share in the past 30 days. IBM's shares have gained 2% year to date.

Price & Consensus: IBM

Hewlett Packard Enterprise: The company is benefiting from strong executions in clearing backlogs and increased customer acceptance. HPE's multi-billion-dollar investment plan to expand networking capabilities will help diversify its business from server and hardware storage markets and boost margins over the long run. Also, easing supply-chain challenges will help it clear backlogs rapidly.

Hewlett Packard views AI, the Industrial Internet of Things and distributed computing as the next major markets. The company's latest agreement to acquire Juniper Networks is not just a financial move but a strategic leap to elevate its competitive stance by expanding its networking domain, particularly in the realms of AI, cloud and hybrid solutions.

HPE has been expanding its AIOps network management capabilities by integrating multiple generative AI Large Language Models within HPE Aruba Networking Central, HPE's cloud-native network management solution, hosted on the HPE GreenLake Cloud Platform.

The company has been benefiting from continued growth in the sales of its accelerator processing unit, primarily driven by rising demand of HPE Cray EX, Cray XT and HPE ProLiant Gen11 AI-optimized servers. HPE's efforts to shift focus to higher-margin offerings like Intelligent Edge and Aruba Central Hyperconverged Infrastructure are aiding the bottom line.

However, organizations are pushing back their investments in big and expensive technology products due to global economic slowdown concerns, which can undermine this Zacks Rank #3 company's near-term prospects.

The Zacks Consensus Estimate for fiscal 2024 earnings has remained steady at $1.88 per share in the past 30 days. HPE's shares have gained 3.9% year to date.

Price & Consensus: HPE

Agilysys: The company is benefiting from steady demand for cloud-native products and supporting software modules, an end-to-end array of software solutions and world-class customer service.

Agilysys operates as a developer and marketer of hardware and software products as well as services, with special expertise in select vertical markets, including retail and hospitality in North America, Europe, the Asia-Pacific and India.

Record high services revenues and significantly improved services margins have helped the company to drive increases in gross margin and net income profitability levels.

This Zacks Rank #3 company's expertise in enterprise architecture and high availability, infrastructure optimization, storage and resource management and business continuity are major growth drivers.

The Zacks Consensus Estimate for its fiscal 2024 earnings has remained steady at 97 cents per share in the past 30 days. Shares of AGYS have declined 12.6% year to date.

Price & Consensus: AGYS

To read this article on Zacks.com click here.

Read the original article on Benzinga