Investing.com - The FTSE 100 index has performed extremely well this year, climbing steadily with very few corrections. The index could benefit from lower interest rates in the future, as the Bank of England may decide to adopt a more flexible monetary policy in the near future. With this in mind, some stocks in the FTSE 100 index could see strong performances, while others are already overvalued and risk falling.

⚠️PROMOTION SPECIAL! Take advantage of AI InvestingPro+ tools and strategies with a 10% discount on the 1-year Pro subscription! CLICK HERE to take advantage before it's too late, and know which stocks to buy and which to shun, whatever the market conditions!⚠️

There are several ways to tell whether a share is overvalued or undervalued. Some investors look to analysts' average forecasts to draw their attention to potential opportunities. However, analysts' opinions and objectives are often biased for a number of reasons, and analysts rarely reveal the precise mechanisms behind their objectives.

Another method is to look at valuation models. Valuation models are mathematical tools used to estimate the value of a company's shares by analysing various factors such as future cash flows, expected growth rates and the associated level of risk.

However, there are many different models, and not all of them are necessarily relevant to the stock being studied.

To help novice investors take advantage of valuation models, and to facilitate the work of experienced investors, InvestingPro has developed Fair Value, an indicator that provides a precise target for each stock on the market based on a synthesis of recognised valuation models.

Find the best and worst stocks in the FTSE 100 with InvestingPro Fair Value

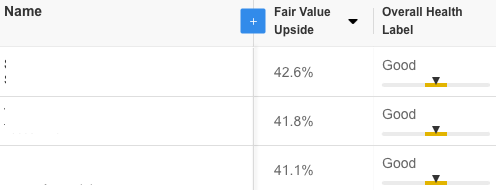

In the remainder of this article, we will use this tool to identify the most overvalued and the most undervalued FTSE 100 stocks. More specifically, we have used the InvestingPro+ screener to identify the stocks in the index that show either a potential upside of more than 40% or a downside risk of more than 20%.

We have identified 3 stocks in the FTSE 100 that have the potential to rise by more than 40% and 3 stocks that are likely to fall by more than 20%.

There are several things to note about this list:

- These stocks are expected to rise by more than 40% according to InvestingPro Fair Value.

- These stocks have attractive upside potential, as well as a good health score, suggesting moderate risk.

To dive into greater detail about these stocks and discover which ones to buy in the coming months, click here to subscribe to InvestingPro+ for one year at the special (limited-time!) discounted rate

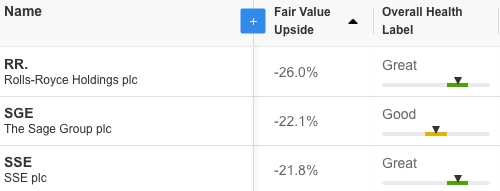

In terms of FTSE 100 stocks to avoid, InvestingPro Fair Value has identified 3:

However, two of these stocks have a health score rated "very good", suggesting that they are still worth watching with a view to buying in the event of a correction.

⚠️PROMOTION SPECIAL! As a reader of our articles, you can take advantage of our InvestingPro stock market strategy and fundamental analysis platform at a reduced rate, with a 10% discount!

-

Click here to take advantage of the special Pro+ rate for a one-year subscription

-

Click here to take advantage of the special Pro+ rate for a two-year subscription

You can find out which stocks to buy and which to sell to outperform the market and boost your investments, thanks to a number of exclusive tools:

- ProPicks: equity portfolios managed by a fusion of AI and human expertise, with proven performance

- ProTips: digestible information to simplify masses of complex financial data into a few words

- Fair Value and Health Score: 2 summary indicators based on financial data that provide instant insight into the potential and risk of each stock.

- Advanced stock screener: Search for the best stocks according to your expectations, taking into account hundreds of financial metrics and indicators.

- Historical financialdata for thousands of stocks: So that fundamental analysis pros can dig into all the details themselves.

- And many more services, not to mention those we plan to add soon!

Don't face the market alone and join the thousands of InvestingPro users so you can finally make the right decisions on the stock market and get your portfolio off the ground, whatever your profile or expectations.

We're also offering a 10% discount on 1 and 2-year Pro subscriptions, but you should be aware that some of the features mentioned in this article, such as searching for stocks by country or index, are reserved for Pro+ subscribers.

With a Pro subscription, however, you can consult the Fair Value, Health Score and ProTips of all stocks, use the basic screener functions, access the outperforming ProPicks strategies managed by IA, and many other services!