KUALA LUMPUR (Reuters) - Chinese automaker Zhejiang Geely Holding Group on Wednesday said it would buy a 49.9 percent stake in Malaysia's national carmaker Proton from conglomerate DRB-HICOM, marking another major Chinese auto investment in Southeast Asia.

Geely, parent company of Hong Kong-based Geely Automobile Holdings Ltd and Sweden's Volvo Car Group, would also acquire 51 percent of Proton unit Lotus, the companies said.

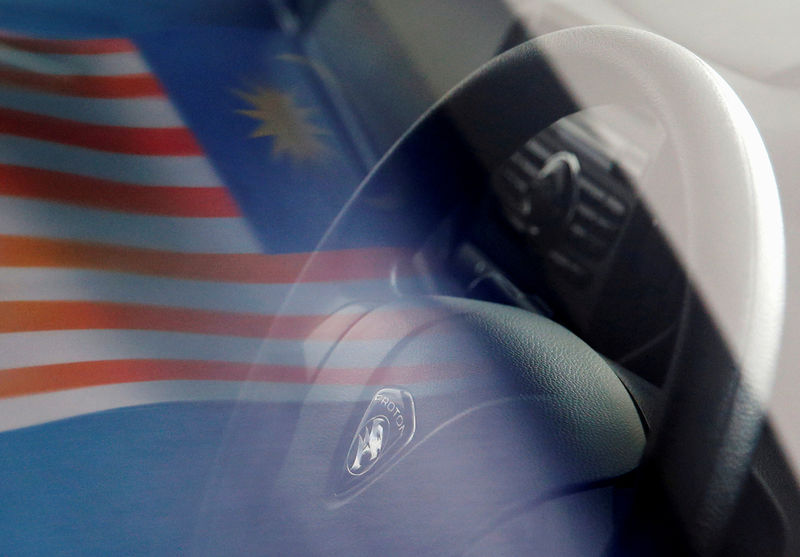

The investment comes on the back of deals worth billions of dollars signed recently between China and Malaysia, but Proton is an asset wrapped in national pride as an emblem of the country's post-independence industrialisation and economic growth.

"Proton will always remain a national car and a source of pride, as Proton will still have a majority hold of 50.1 percent," Malaysia's Second Finance Minister Johari Abdul Ghani said at a press conference to announce the deal.

"Our very own much-loved brand now has a real chance in making a comeback, a huge one I hope."

No value for the deal was released, but a statement from DRB-HICOM said an agreement with Geely was expected to be signed in July.

Chinese automakers increasingly see Southeast Asia as a growth market as their technological know-how and vehicle quality improves. Shanghai-based SAIC Motor Corp moved to build a plant in Indonesia in 2015 and formed a joint venture in Thailand three years earlier, while Dongfeng Motor Group is also interested in the region.

"Japanese automakers already dominate Southeast Asia's auto market and they make the region a tough place to do business for newcomers. This deal gives Geely an already-established distribution network," said Yale Zhang, head of Shanghai-based consulting firm Automotive Foresight.

"Geely can inject into that Proton network better technologies and better-quality cars they have developed with Volvo’s help. It’s clear-cut in that sense."

The vetting process to find a foreign strategic partner for Proton started last year and involved 15 global auto players, which were eventually short-listed to three final candidates, Johari said.

Other companies that have expressed interest in Proton include Peugeot maker PSA, Japan's Suzuki Motor Corp and French car maker Renault SA (PA:RENA).

NATIONAL PRIDE

Geely is expected to offer Proton some of the latest vehicle technologies it has developed with Volvo's input, with the aim of growing its sales overseas and recovering some of the global presence the Malaysian automaker has lost in recent years.

Founded in 1983 during former prime minister Mahathir Mohamed's industrialisation push, Proton at its peak boasted of a domestic market share of 74 percent in 1993.

But sub-par cars, poor after-sales service and tough competition from foreign automakers dented profits - with its market share currently at around 15 percent.

The national carmaker largely re-badges cars of foreign manufacturers to sell in the Malaysian market, but the quality has diminished in recent years.

The Malaysian government handed out a 1.5 billion ringgit (280.8 million pounds) financial aid to Proton in April last year, on the condition that the carmaker find a strategic foreign partner soon.

As well as an entry point into Southeast Asia, Proton gives Geely access to right-hand-drive (RHD) markets around the world, including Malaysia, Britain, India and Australia.

HSBC advised Geely on the deal.