Following these transactions, Assaf holds 523,564 shares indirectly through the Assaf and Liron Wand 2014 Revocable Trust. The sales were conducted under a Rule 10b5-1 trading plan adopted on March 11, 2024. InvestingPro analysis indicates the stock is currently slightly undervalued, with 12 additional exclusive insights available to subscribers. For comprehensive insider trading analysis and detailed Fair Value calculations, access the full Pro Research Report, available for over 1,400 US stocks. InvestingPro analysis indicates the stock is currently slightly undervalued, with 12 additional exclusive insights available to subscribers. For comprehensive insider trading analysis and detailed Fair Value calculations, access the full Pro Research Report, available for over 1,400 US stocks.

Following these transactions, Assaf holds 523,564 shares indirectly through the Assaf and Liron Wand 2014 Revocable Trust. The sales were conducted under a Rule 10b5-1 trading plan adopted on March 11, 2024.

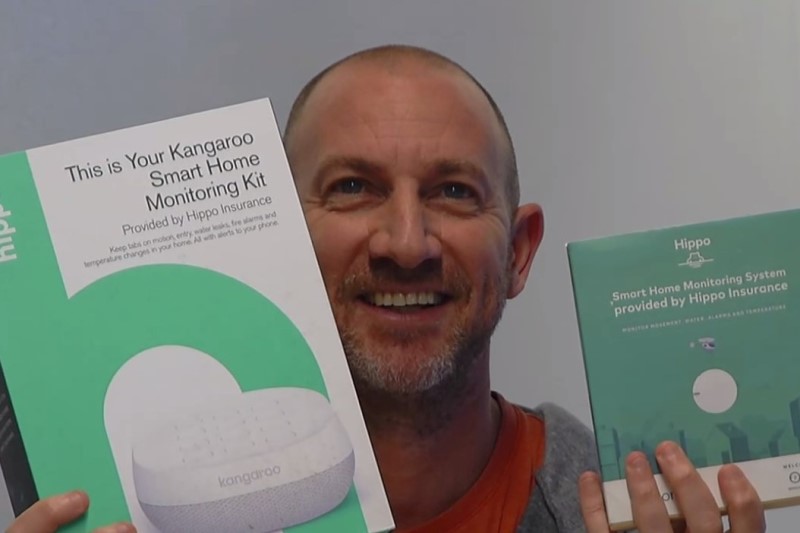

In other recent news, Hippo Holdings Inc. has undergone significant leadership changes and demonstrated impressive financial performance. The company has reported robust growth in total generated premium (TGP) and revenue for the second quarter of 2024, with strategic initiatives leading to increased customer lifetime value and reduced acquisition costs. The company's adjusted EBITDA loss improved by $62.8 million year-over-year, and it anticipates a positive adjusted EBITDA by the fourth quarter of 2024.

In leadership news, the company welcomed Andrea Collins back as its Chief Marketing Officer, bringing over two decades of marketing experience. Concurrently, Yuval Harry, the Chief Revenue Officer, transitioned from his executive role to a consultative position. Further bolstering the team, William Malone, an experienced insurance industry professional, was appointed as Vice President, Head of Agency.

In other developments, Hippo Holdings' warrants were delisted from the New York Stock Exchange due to persistently low selling prices. However, this decision does not impact the company's common stock, which remains listed on the NYSE. These recent developments reflect Hippo's ongoing efforts to navigate financial markets and achieve its financial targets.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.