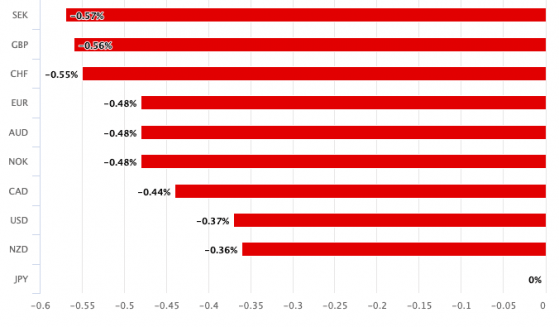

PoundSterlingLIVE - The Japanese Yen fell against all its peers on Thursday after a Bank of Japan official cautioned against expectations for significant interest rate hikes.

Bank of Japan (BoJ) Deputy Governor Shinichi Uchida said it is hard to see rapid interest rate rises, even after it exits its negative interest rate policy (NIRP).

"Even if the bank were to terminate the negative interest rate policy, it is hard to imagine a path in which it would then keep raising the interest rate rapidly," Uchida told local business leaders in Nara.

The Yen fell, suggesting some disappointment by market participants, but the moves are curious and liable to be reversed. After all, the comments still confirm that NIRP will end.

"Uchida's comments raise the uncertainty about the extent of potential BoJ hikes. Still, the focus on a post-lift-off scenario bolsters the case for the BoJ ending the NIRP in coming months," says Kong.

Commonwealth Bank joins peers in expecting the BoJ to start its hiking cycle with a 10bp hike in April.

"We expect two more 10bp hikes by the end of 2024, in line with current market pricing. Nevertheless, the strong USD and Japan’s strong equity market performance will keep USD/JPY supported in the near term in our view," adds Kong.

The Japanese Yen could reverse some of the significant weakness it experienced in 2023 as other central banks begin cutting interest rates, just as the BoJ raises its policy rate.

Although it is now off its 2023 lows, expected delays to the start of U.S. Federal Reserve rate cuts have put the Yen back under pressure in 2024.

An original version of this article can be viewed at Pound Sterling Live

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI