Proactive Investors - Few will argue that low unemployment is a bad thing, but it also poses a conundrum for the US Federal Reserve.

Despite recession either coming soon or already here depending on who you ask, the US added 135,000 more jobs in the private sector in December than expected, per yesterday’s data reading.

Cue the Fed hawks sharpening their talons as they back more interest rate rises in the months to come.

According to recently released Federal Open Market Committee minutes, officials said they’d need to see “substantially more evidence” of easing inflation before loosening their grip on the economy while warning that an “unwarranted easing in financial conditions… would complicate the committee’s effort to restore price stability”.

The US Dollar Index (DXY) salivated over the prospect of a higher peak rate, adding 0.8% to close at a four-week high of 104.805.

DXY’s momentum continued in this morning’s Asia trading window, having climbed to 104.94 at the time of writing.

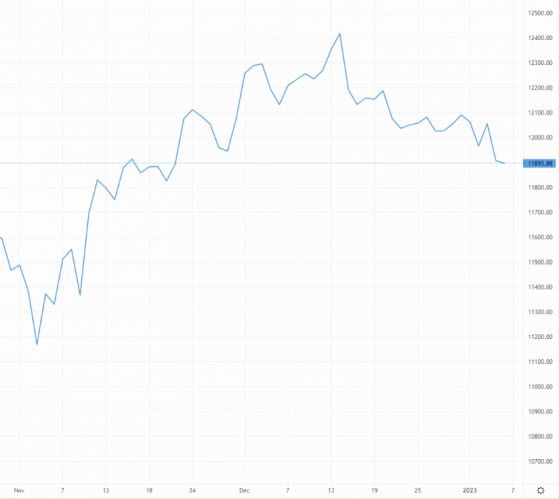

GBP/USD consequently dipped nearly 150 pips to close Thursday at 1.190, with more downside expected in today’s session.

GBP/USD falls back, encouraged by Fed hawks – Source: capital.com

The euro retreated to three-week lows against the greenback, with the EUR/USD pair currently changing hands at 1.051.

Indicative of the European Central Bank’s persistent hawkishness, despite surprisingly soft German and Italian inflation data, the EUR/GBP pair showed strength by closing 0.4% higher at 88.33p on Thursday. The pair remained on the upside in this morning’s Asia session, inching higher to 88.34p.

A clearer picture of European inflation will come later this morning when flash inflation for the whole Euro Area is released.

Consensus estimates are 9.7%. Anything softer could encourage a retreat on recent euro gains against the pound.

Read more on Proactive Investors UK