(Bloomberg) -- Turkey’s central bank left its benchmark interest rate unchanged in the first monetary policy meeting under its newly appointed governor.

The Monetary Policy Committee left its key rate at 19% Thursday, in line with the forecasts of most analysts in a Bloomberg survey. The two dissenters, HSBC Bank PLC and Capital Economics Ltd, predicted the meeting would deliver a reduction of 50 and 200 basis points, respectively.

The lira extended gains after the decision and was trading 0.7% higher at 8.0252 per dollar at 2:01 p.m. in Istanbul.

Installed after President Recep Tayyip Erdogan abruptly fired his predecessor following a bigger-than-expected rate increase, Sahap Kavcioglu was under pressure to reduce rates but has so far signaled he would not rush to loosen the stance he inherited.

In a written interview with Bloomberg after his appointment last month, Kavcioglu said markets shouldn’t view a rate cut at the April 15 Monetary Policy Committee meeting as a given, easing some concerns among investors.

“Kavcioglu’s initial communication to markets has done enough to alleviate apprehensions,” said Ehsan Khoman, Head of Emerging Market Research for Europe, Middle East and Africa at MUFG Bank in Dubai. Turkey “does not have the policy room to lower rates this year given the elevated inflation outlook” but Kavcioglu’s dovish views suggest the central bank will eventually take a more accommodative stance, he said before the meeting.

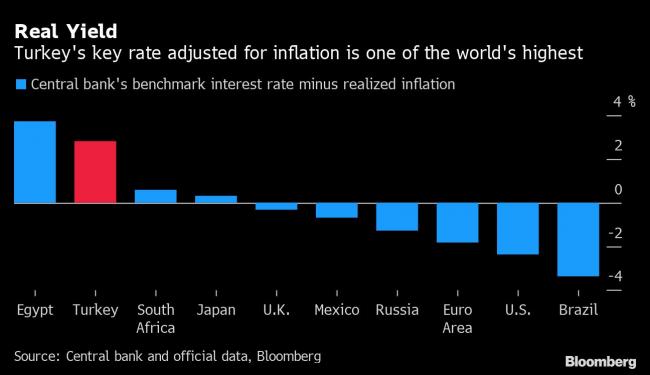

Turkey raised its benchmark by 200 basis points on March 18, at Naci Agbal’s final rate-setting meeting as governor, elevating the key rate adjusted for inflation to one of the world’s highest. A professor of banking, Kavcioglu was among the critics of that move, saying it could damage economic growth.

Last week, Erdogan said the government was determined to both reduce inflation and cut interest rates to single digits, prompting a slide in the lira. The currency has weakened more than 10% against the dollar since the unexpected appointment of Kavcioglu. Foreign investors sold a net $1.2 billion in Turkish equities and a net $1.25 billion in government bonds and the benchmark Borsa Istanbul 100 Index slid 7.6% during the same period.

Inflation accelerated to an annual 16.2% through March, up from 15.6% the previous month because of a global oil rally and weaker currency, leaving the new central bank chief little room to enact the interest-rate cuts that would mollify Erdogan, who holds the unorthodox view that high interest rates cause inflation.

©2021 Bloomberg L.P.