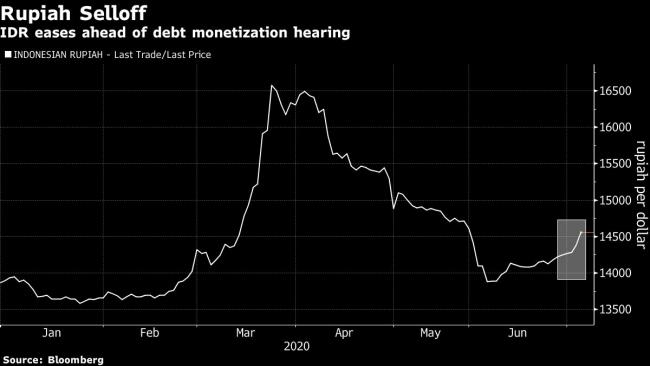

(Bloomberg) -- Indonesia’s rupiah sank by the most in two months ahead of a parliamentary hearing on the nation’s debt monetization plan, prompting intervention by the central bank.

The currency dropped as much as 1.5%, its biggest decline since May 4. Even after the intervention, it was 1.3% lower at 14,570 per dollar at 2:05 p.m. in Jakarta

“Investors are a bit spooked by debt monetization concerns, increasingly so since the figure is quite big and will be a pain to unwind later,” said Yanxi Tan, a foreign exchange strategist at Malayan Banking Bhd.

Parliament’s financial commission in a hearing on Monday will scrutinize Bank Indonesia’s agreement to fund $40 billion of the government’s fiscal response to fight the coronavirus.

Febrio Kacaribu, head of the finance ministry’s fiscal office, said Friday that both sides were being careful to make a plan that would be “very prudent” and maintain monetary independence, fiscal integrity and stability.

Still, some investors are concerned that it has sparked the risk of a downgrade of Indonesia’s sovereign rating.

Indonesia Risks Losses by Deeper Dive Into Debt Monetization

“Markets are concerned that there will be a marked increase in liquidity as Bank Indonesia increases holdings of government bonds to support fiscal authorities,” said Chang Wei Liang, a macro strategist at DBS Bank Ltd. in Singapore.

The nation’s 10-year government bond yield was steady at 7.23% on Friday.

Meanwhile, a spike of coronavirus cases was also weighing on the currency after the country reported 1,624 infections on Thursday, the biggest single-day jump so far.