PoundSterlingLIVE - Pound Sterling looks set to end the week on a softer footing against the Euro, although the broader backdrop suggests a limited likelihood of any substantial losses.

The GBP/EUR exchange rate is currently down 0.20% on the week, which, if held into the close, would make for the biggest weekly decline since mid-December.

0.20% is by no means a significant weekly movement for a currency pair, but that it would be the largest loss in weeks reflects the collapse in volatility in Pound Sterling, and the foreign exchange market more broadly.

"Implied volatility is particularly low in GBP, at close to the lowest in the past thirty years," says Joseph Capurso, Head of International and Sustainable Economics at Commonwealth Bank.

Kit Juckes, an analyst at Société Générale, speaks of a "strangled" foreign exchange market. He explains that expectations for interest rate cuts at the largest central bank are moving in lock-step, meaning little divergence in performance between the currencies.

Pound-Euro spent February consolidating above the 1.1660 area following the strong recovery witnessed at the start of the year and these patterns are likely to extend into the first half of March.

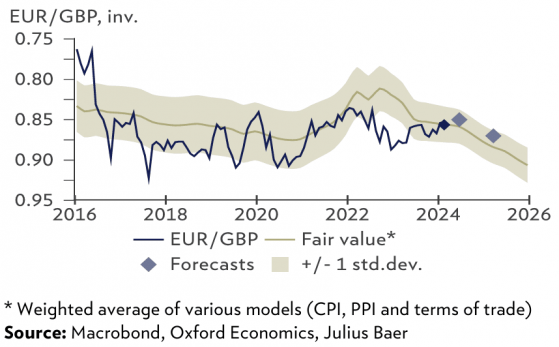

"Despite the technical recession, the GBP remains resilient. Recovering momentum supports our view of a late-cutting BoE. A small rise in rate differentials will likely help to stabilise the GBP," says David Alexander Meier, an analyst at Julius Baer in Zurich.

A potential source of near-term excitement could be next week's Spring Budget announcement from Chancellor Jeremy Hunt, which will see him attempt to boost confidence in the economy and potentially cut taxes.

These tax cuts will likely be limited owing to the state of UK finances but would offer a fiscal boost that can underpin the economic recovery in 2024 and discourage the Bank of England from cutting interest rates further.

The Bank is expected by the majority of analysts we follow to cut interest rates after both the European Central Bank and U.S. Federal Reserve, which would suggest the Pound can remain supported over the coming weeks.

However, should March inflation data undershoot expectations as was the case in February, we could see these assumptions challenged, leading to a weakening in the Pound.

But as mentioned, weakness is likely to be short-lived.

Further tests of resistance at 1.1760 could be on the cards if the mid-month official UK data releases confirm the UK economy returned to growth in January and February.

Incoming survey data (particularly the PMIs) suggest the economy expanded in January and February, and this should be reflected in ongoing tightness in the official labour market figures and GDP numbers.

"The UK was in a technical recession in H2 2023, as inflation hit consumption and exports declined. Leading indicators signal that the worst is over and point to a modest recovery in 2024," says Meir.

An original version of this article can be viewed at Pound Sterling Live