PoundSterlingLIVE - The British Pound has risen to fresh multi-month highs but the coming week could result in a setback if inflation data surprises either higher or lower and the Bank of England strikes a cautious tone on Thursday.

Ahead of the event risk, momentum trends in both GBPEUR and GBPUSD suggest further gains could be possible as it is often futile to actively guess the top in a trending market and position for a reversal.

The Pound to Euro exchange rate (GBPEUR) on Friday reached its strongest level since August 2022 at 1.1734 and remains in touch with this high at the start of the week.

1.20 looks like a multi-week topside target in GBPEUR in the event the current trends persist.

The Pound to Dollar exchange rate (GBPUSD) rose to its highest level since April 2022 at 1.2848 on Friday and is at 1.2823 at the time of writing.

The strength of the GBPUSD rally makes calling a technical ceiling difficult at this juncture.

"We have slightly revised up our projections for the pound against the dollar, to GBP/USD 1.27-1.28-1.29-1.29 on a 1m-3m-6m-12m horizon from GBP/USD 1.25-1.26-1.27-1.28 previously," says Asmara Jamaleh, Economist at Intesa Sanpaolo (BIT:ISP) Bank.

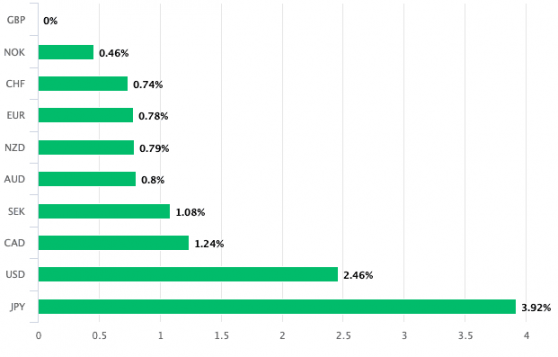

Pound Sterling has been boosted by rising short-term UK bond yields which in turn reflect expectations for further Bank of England rate hikes, owing to the UK's 'sticky inflation' problem.

The immediate risk to the Pound Sterling uptrend lies with the CPI inflation report on Wednesday, June 21.

A downside miss here could see Bank of England rate hike expectations deflate, which would prompt an unwind in GBP strength.

The Bank of England then delivers its next hike the following day on June 22 and could introduce some 'dovish' guidance if inflation undershoots, after all the Bank will be eager to bring an end to its hiking cycle to avoid prompting a deep recession.

"Our conclusion is that in addition to next week, the MPC will raise the Bank rate in August and September resulting in a terminal rate of 5.25%. Previously we had expected the Bank rate to peak at 4.75%. Our baseline case is that rates will not rise as far as 6%, but policymakers are currently in a state of heightened data dependency and we note that significant risks exist in both directions," says Philip Shaw, Economist at Investec.

From a risk management perspective, clearing some FX exposure at current rates would therefore represent a hedge against any downside surprises.

Brad Bechtel at Jefferies, the investment bank, says the Bank of England is dealing with an even harder situation than the ECB or Fed given their inflation numbers look far worse in the UK.

"Growth is holding up well despite the inflation figures and cost of living impact and the expectation is that the BoE will reluctantly keep hiking. GBP will remain better bid vs. USD, EUR and JPY for now," he says.

But another risk would be inflation coming in well above expectations, a counterintuitive position to what has already been written above regarding the impact of below-consensus inflation.

This is because there is a risk an inflation blow-out could prompt a surge in bond yields (pushes up mortgage rates etc) and raises the prospect of a deep recession forming at some point in the coming months.

Such an outcome could be GBP negative.

So for the immediate term, an on-target inflation print would likely be required to underpin the Pound's uptrend against the Euro and Dollar.

An original version of this article can be viewed at Pound Sterling Live