Proactive Investors - As it turns out, the US is still beating the UK in terms of gross domestic product.

Yesterday showed that UK GDP growth is slowing faster than expected, while across the Atlantic, the US economy grew 3.2% in the third quarter, better than the 2.9% forecast, thus rebounding from two straight quarters of contraction.

Consumer spending among Americans rose more than anticipated (2.3% versus 1.7% forecast), as growth in healthcare and other services partially offset a decrease in spending on motor vehicles, food and beverages.

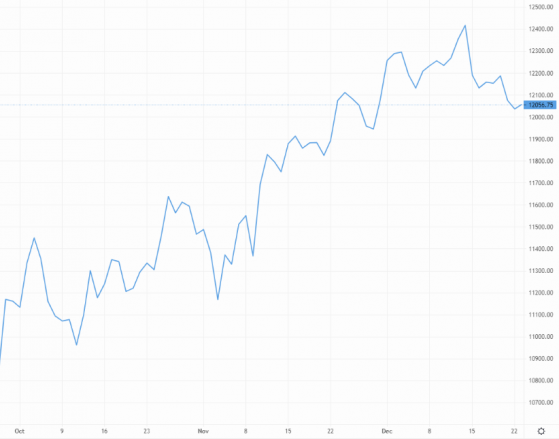

Cable responded by falling sharply from an intraday high of 1.214, hitting lows of 1.199 before entering a slight correction.

By the end of the day, the pound had lost around 0.3% to 1.203 but has inched higher to 1.204 in this morning’s Asia trading window.

GBP/USD reacts to US GDP growth – Source: capital.com

The euro continues to gain against the pound, with another quarter percent added yesterday and a handful of pips added this morning.

At 88.12p, the EUR/GBP pair is heading above November highs, with October highs in its sights next.

EUR/USD seems to be running of steam after six weeks of consistent gains. Currently changing hands at 1.061, the pair has been trading sideways for a good week now.

Inflation continues to rattle Japan, unsurprising given the central bank’s general refusal to budge on its hands-off monetary policy.

In this morning’s reading, the annual inflation rate crept up to 3.8% from 3.7% a month earlier, the highest reading since January 1991, due to high prices of imported raw commodities and persistent yen weakness.

After falling sharply at the start of the week on news that the Bank of Japan may at least reconsider its yield curve policy, the USD/JPY regained its composure and currently stands at 132.28, with GBP/JPY changing hands at 159.68.

Read more on Proactive Investors UK