Proactive Investors - Cable took a sharp 0.4% fall to 1.235 throughout yesterday’s session in further confirmation that the pound’s strength against the dollar throughout January may have run out of steam at the 1.240 price point.

For now, the pair has stayed put at 1.235, with a spinning-top candlestick pattern inferring a general climate of indecision among traders in anticipation of the UK, EU and US central bank interest rate decisions scheduled for the following two days.

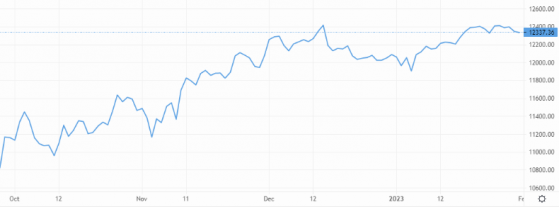

GBP/USD peters out – Source: capital.com

The dollar appears well supported this week even though a dovish 25-basis point (bps) hike from the Federal Reserve is broadly expected, with the US Dollar Index (DXY) adding 0.35% to 101.86 yesterday and gaining further to 101.88 in this morning’s opening hours.

One near-term effect of the rate-hike cycle in the US has been the sharp rise in overnight federal funds borrowing as deposit withdrawals send banks scrambling for liquidity from other sources.

This Bloomberg report suggests that a seven-year high of US$120bn in daily federal funds borrowing was clocked on 27 January.

EUR/USD reversed from an intraday high of 1.091 to close Monday 0.2% lower at 1.084, with incremental losses chalked up this morning too.

Ever the volatile trading pair right now, EUR/GBP finished 0.2% higher at 87.84p on Monday, but today has been comparatively bearish, with traders pushing the pair 10 pips down to 87.74p.

On today’s economic calendar, UK consumer credit borrowing is due later this morning. Spending actually picked up sharply for the month of November in preparation for the holiday season, though December figures are expected to show that consumers are starting to rein things in again.

Euro-area GDP growth will be announced later, with year-on-year estimates suggesting a 40 bps decline to 1.8% for the last quarter of 2022.

Read more on Proactive Investors UK