By Ben Hirschler

LONDON (Reuters) - U.S. drugmaker AbbVie (N:ABBV) raised its offer for Shire (L:SHP) to 30.1 billion pounds on Tuesday, hoping to win over its reluctant target after three earlier offers were rejected.

The latest 51.15 pounds a share cash-and-stock offer is 11 percent higher than AbbVie's previous proposal of 46.26 pounds, which the London-listed hyperactivity and rare diseases specialist had said fundamentally undervalued the company.

Industry analysts said it was unlikely to be enough to get a deal done. Shire said its board would meet to consider the higher offer, which it added it did not receive before AbbVie announced it to the market.

Shares in Shire fell on disappointment the U.S. group had not offered more, or raised the proportion of cash, amid worries that the two sides might not be able to agree a final price. AbbVie also slid, reducing the stock element of its bid.

AbbVie is eager to buy Shire both to reduce its tax bill by moving its tax base to Britain - a tactic known as inversion - and to diversify its drug portfolio. The U.S. company currently gets nearly 60 percent of its revenue from rheumatoid arthritis drug Humira, the world's top-selling medicine, which loses U.S. patent protection in late 2016.

Chief Executive Richard Gonzalez has pressed the case for his pursuit of Shire in a series of meetings with shareholders on both sides of the Atlantic, after setting out the strategic rationale for a deal on June 25.

AbbVie said it and its financial adviser J.P. Morgan had now met with, or spoken to, Shire investors who represented a majority of Shire's shares.

"I believe they are generally supportive of this transaction and I can tell you that this offer is responsive to the feedback we have received," Gonzalez told Reuters in a phone interview.

He is now urging shareholders to push the Shire board to engage in talks.

Industry analysts said the sweetened offer improved AbbVie's chances of getting Shire into discussions but was unlikely to be enough to clinch a deal.

"It gets AbbVie closer to a deal, but I'm not sure it's quite a knock-out offer," said Atlantic Equities analyst Richard Purkiss.

"What AbbVie needs is the willingness of Shire to at least engage. I'm not sure this offer in itself is high enough to be absolutely sure of that - it's possible, but no means certain."

Several analysts have valued Shire in the mid-50s pounds per share or higher. Bernstein said there was a good chance Shire would reject the new offer, while trying to get better terms.

Gonzalez refused to be drawn on the possibility of increasing his offer further, but said he was not aware of any rival counterbidders, adding he was not ruling out a hostile move if Shire failed to engage.

"We're going to leave all of our options open and that includes that option as well," he said.

Jefferies analysts said in a note: "If Shire does not begin to indicate a price that will open the books and begin discussions with AbbVie, we suspect there is a possibility that AbbVie goes hostile with a 55 (pounds) offer."

U.S. PHARMA LURED TO BRITAIN

AbbVie's move on Shire is the second attempt by a U.S. drugmaker to buy a London-listed rival after Pfizer's (N:PFE) $118 billion (68.89 billion pounds) pursuit of AstraZeneca (L:AZN) failed last month - another deal driven in large part by tax savings.

Shire shares ended 2.6 percent down on the day at 45.30 pounds following news of the latest offer, which comprises 22.44 in cash and 0.8568 AbbVie shares for each Shire share. AbbVie shares, meanwhile, lost 2.8 percent.

AbbVie said the new offer reflected a substantial sharing of potential synergies between shareholders of each firm, adding Shire shareholders would own 24 percent of the enlarged group.

Gonzalez reiterated that it wanted to move quickly to get a deal, arguing it would create more value from Shire's assets than Shire could do on its own.

Under British takeover rules AbbVie has until July 18 to announce a firm offer for Shire or walk away.

Shire, while founded in Britain, is today managed out of Boston, headquartered in Dublin and has most of its sales in the United States, resulting in a minimal business footprint in Britain. As a result, the potential takeover of the company has not created the political storm that accompanied Pfizer's pursuit of AstraZeneca.

Its chief executive, Flemming Ornskov, has said he is happy for the company to be sold at the right price - but he has also laid out a detailed case as to why it worth a lot more than AbbVie was offering.

Ornskov has forecast his company's product sales will double to $10 billion by 2020 as Shire moves into new disease areas.

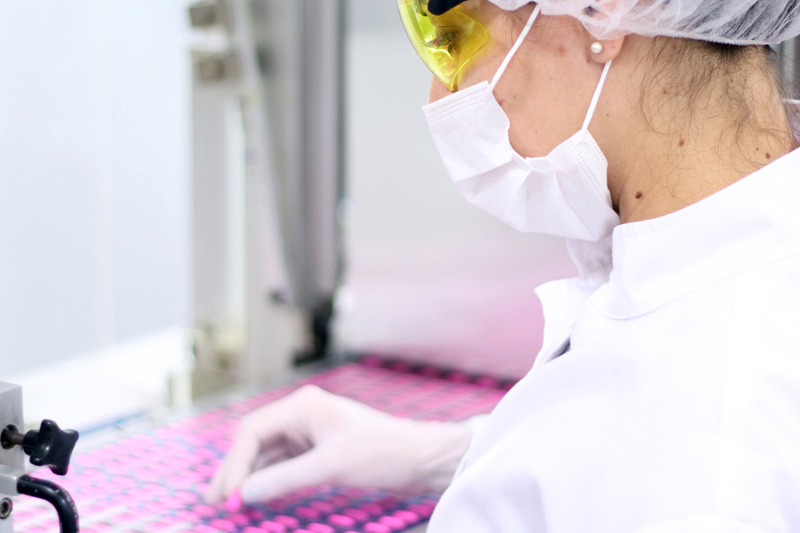

Around 40 percent of Shire's sales come from attention deficit hyperactivity disorder (ADHD) medicines, including Aderall XR and Vyvanse, while the firm also sells pricey drugs to treat rare genetic disorders and is building up a portfolio of treatments in ophthalmology and other specialised areas.

(Additional reporting by Paul Sandle, Tricia Wright and Ransdell Pierson; Editing by Louise Heavens)