By Denis Balibouse

BERNE (Reuters) - France and Switzerland agreed on Wednesday to cooperate more closely on French efforts to crack down on citizens with hidden Swiss bank accounts to root out tax dodgers and cheats.

Countries around the world are trying to crack down on undeclared funds held in offshore havens after the global financial crisis strained government budgets and made the need to maximise tax receipts more pressing.

Last month, Switzerland effectively ended Swiss banking secrecy by agreeing to join other countries in sharing tax information once that is established as an international standard.

France has taken a tougher stance than its neighbours on the level of cooperation it has demanded from Switzerland in the meantime. Talks between the two have also been complicated by a long-running dispute over inheritance tax for wealthy French citizens in Switzerland.

Swiss parliament recently rejected reforms on inheritance taxes and France responded by cancelling an existing treaty on the issue.

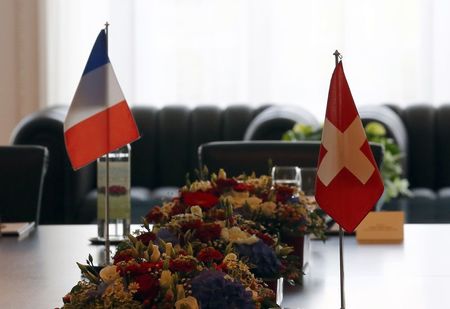

The changes agreed by French Finance Minister Michel Sapin and his Swiss counterpart, Eveline Widmer-Schlumpf, in Berne bring their cooperation in line with standards set out by the Organisation for Economic Co-operation and Development (OECD).

The two will now cooperate on so-called group requests, which allow foreign tax authorities to get at data on groups of their citizens holding Swiss bank accounts without knowing their identities, and on individuals who are not named if the French authorities can identify them by some other means.

"Improving the exchange of information on judicial request is a step towards the automatic exchange of information, which is set to become standard in international tax cooperation," Sapin said in a statement.

The two ministers also signed a pact pledging to keep talking and cooperating on tax fraud and evasion.

Tackling tax evasion is an issue French President Francois Hollande is pushing hard to help trim public debt without further stifling France's recession-stricken economy and also because of a tax scandal involving a member of his cabinet.

Former budget minister Jerome Cahuzac was forced to resign last March after revelations he held a secret Swiss bank account, which he later admitted.

France's junior budget minister Christian Eckert told lawmakers this week the government has taken in just over 1 billion euros (£0.80 billion) in taxes so far this year from taxpayers coming clean on previously undeclared assets held abroad, of which 80 percent are in neighbouring Switzerland.

France's Finance Ministry now expects 1.8 billion euros in gains from regularisation of taxpayers' undeclared assets, up from 800 million euros initially flagged for this year's budget.

A French parliament report last year into data leaked by a former employee from HSBC revealed $5 billion of undeclared assets in thousands of Swiss bank accounts.

(Reporting by Katharina Bart and Ingrid Melander in Paris; Writing by Katharina Bart; Editing by Sonya Hepinstall)