Proactive Investors - All eyes are peeled on the US inflation reading due this afternoon.

Forecasters expect to see the sixth straight slowdown for the month of December, with an annual rate of 6.5% compared to 7.1% in November.

On a monthly basis, the consumer price index is expected to flatten following four consecutive months of increases, in part due to a notable drop in energy prices.

For better or worse, the reading should at least provide some clarity for the next interest rate decision in February.

A softer-than-expected inflation read will encourage a dovish 25 bps and drive the greenback further down, while a higher read will of course do the opposite. For what it’s worth, the Federal Reserve has made no overtures to reducing its 5%+ terminal rate.

The US Dollar Index (DXY) has plateaued in anticipation, having closed only marginally lower yesterday and barely moved from its 102.82 position today.

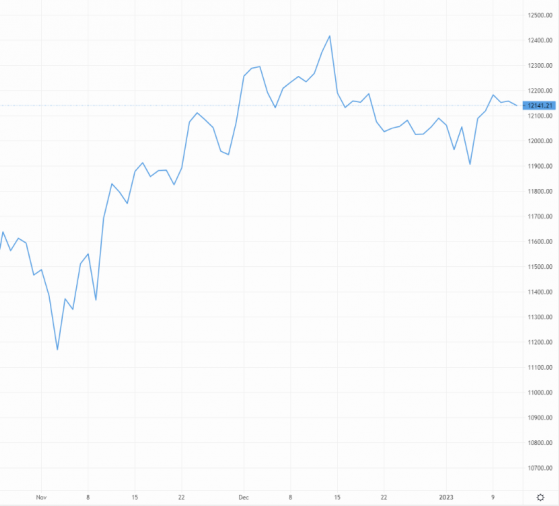

Will Cable be seen higher or lower post-inflation read? – Source: capital.com

GBP/USD has fallen back around 20 pips to 1.213 this morning, following an uneventful Wednesday trade. Betting on a pound rally would be contingent on US inflation matching or bettering market expectations.

EUR/USD continues to try to beat May 2022 highs, although the pair was seen marginally lower at 1.076 in this morning’s Asia session. Once again, if the US inflation read does what is expected of it, the pair could break above 1.078, last seen eight months ago.

EUR/GBP was pushed back from the 88.5p resistance point in yesterday’s session, though the pair managed to close 0.2% higher at 88.53p and has moved up to 88.62p this morning.

Read more on Proactive Investors UK

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI