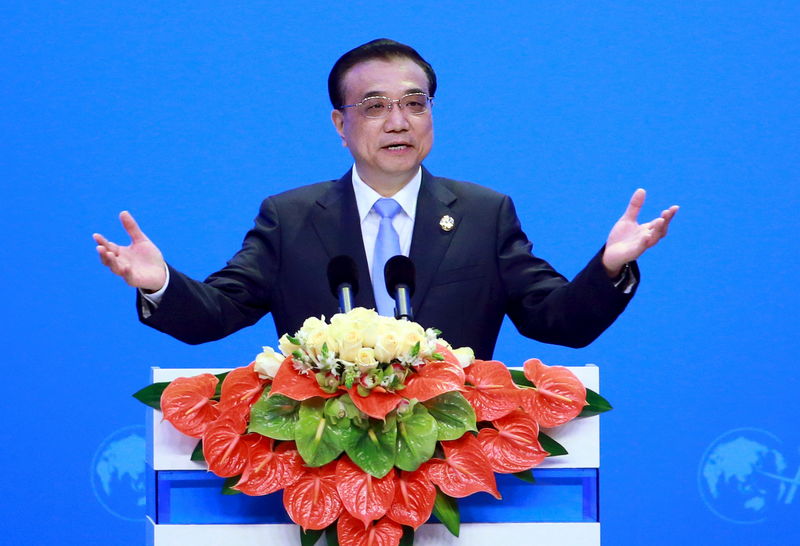

BEIJING (Reuters) - Chinese Premier Li Keqiang said he expects tax reforms will lower the cost of innovation and help create jobs for more than 10 million university and vocational school graduates, according to a statement on the government's web portal on Monday.

That figure would well exceed estimates of layoffs as China reforms its industrial sector to eliminate excess capacity and inefficiency. Sources told Reuters last month China planned to lay off up to 6 million workers in state-owned companies over the next two to three years in the reform effort.

Li did not offer a time frame for when the jobs would be created.

Li repeated his expectations that the reforms would cut 500 billion yuan (54 billion pounds) in tax this year in his remarks to the State Administration of Taxation on Friday.

The reforms "thus will accelerate China's continuing transition from old to new, help maintain medium to high speed economic growth and move in the direction of high-quality growth," he was quoted as saying.

He urged the central and local governments, as well as companies, to prepare for tax reforms by assessing likely difficulties and summarizing their experiences from early pilot reforms.

Li also said the tax system must be improved to avoid local protectionism, fraud and tax evasion.

China's hugely inefficient state sector employed about 37 million people in 2013. The expected layoffs would be the country's largest retrenchment since it restructured state-owned enterprises between 1998 and 2003.

While the restructuring would cost the government in aid to laid-off workers, Li has stressed that reforms, including tax cuts and eliminating red tape, and innovation, would create new growth.