By William Schomberg and Andy Bruce

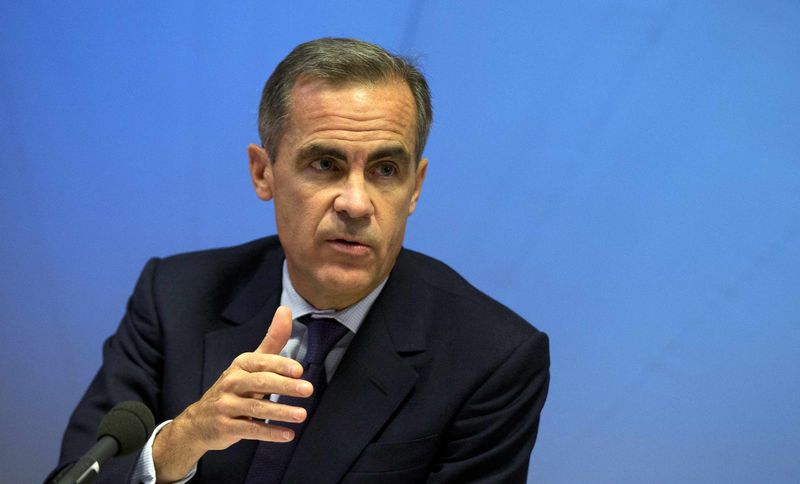

LONDON (Reuters) - The Bank of England will provide instant information about its interest rate discussions and plans to hold fewer policy meetings under the latest set of changes put forward by Governor Mark Carney.

In an overhaul of the way the Bank reveals its thinking on monetary policy, the BoE said it would publish minutes of its debates alongside its decisions, rather than wait nearly two weeks as it does now.

The change would come into effect in August 2015.

"By removing the present drip-feed of news ... in favour of a single monetary policy announcement, we believe these arrangements will enhance the effectiveness of our monetary policy communications, making the policy signals we send as clear as possible," Carney told reporters.

The Bank's quarterly Inflation Report, which spells out its latest thinking on the economy and its forecasts, will also be published at the same time as policy decisions, avoiding the potential for mixed signals.

Some investors were wrong-footed last month when minutes of the Bank's November meeting showed more differences among policy makers over keeping interest rates unchanged than had been apparent from the Inflation Report published a week earlier.

The Bank also said on Thursday it wanted to hold only eight monetary policy meetings a year starting in 2016, down from 12 now, in line with the Federal Reserve's schedule. The European Central Bank will move to a meeting every six weeks in 2015.

British Finance minister George Osborne welcomed the reforms and said he would seek to pass legislation needed to change the BoE's meetings schedule after May's election.

In a further change announced on Thursday, the BoE said it would start publishing transcripts of its policy discussions with an eight-year lag, effective from March.

However, in a nod to concerns that such a change could curb frank discussion, deliberations on the first day of meetings will not be reported.

Kevin Warsh, a former Fed governor who led a review of transparency at the Bank and made the proposals adopted by the BoE, said discussions among its policymakers were "second to none" and more robust than at the Fed where discussions were "rather set-piece".

Thursday's announcement represents the latest changes at the BoE under Carney.

Since he arrived in mid-2013, it has tried to give a clearer steer on how long it is likely to keep rates at their record low, replaced several top monetary policymakers and brought its financial regulation operations into the heart of the Bank.

Carney said that moving to eight meetings per year would give an equal chance of a rate move at each meeting, in contrast to the BoE's current practice of preferring to change rates when they coincide with its quarterly economic forecast updates.

Under the changes, meetings of the Monetary Policy Committee will take place on three days -- Thursday, Monday and Wednesday, followed by the announcements on Thursday -- to provide the time for the minutes to be drawn up.

Currently, the MPC typically meets on Wednesday and Thursday.

The BoE also said it planned to hold in 2016 four joint meetings of the MPC and the Financial Policy Committee, which is tasked with dealing with potential risks to the economy from the banking system.

(Writing by William Schomberg and David Milliken, additional reporting by Liisa Tuhkanen,; Editing by Toby Chopra)