By Geoffrey Smith

Investing.com -- When tight supply meets rampant demand, there is little that even coherent policy-makers can do about it.

Sadly for the global economy, the oil market doesn’t even have the modest consolation of coherent policy right now.

On the one hand, there is the Organization of the Petroleum Exporting Countries and its partners, notably Russia. This group, which controls around 40% of global oil supply and has the only significant spare capacity that can be easily turned on and off, has promised to raise their output by 400,000 barrels a day every month until it has reversed all the output reductions it made at the start of the pandemic to keep the market balanced.

Unfortunately it’s doing no such thing. Past indiscipline, corruption and shockingly poor governance have left many of its members unable to pump. According to Petroleum Argus, the bloc only managed to raise it by 230,000 barrels a day in October. Failure to keep up with scheduled increases in previous months means that it’s currently pumping 690,000 b/d less than it had led the world to expect by now.

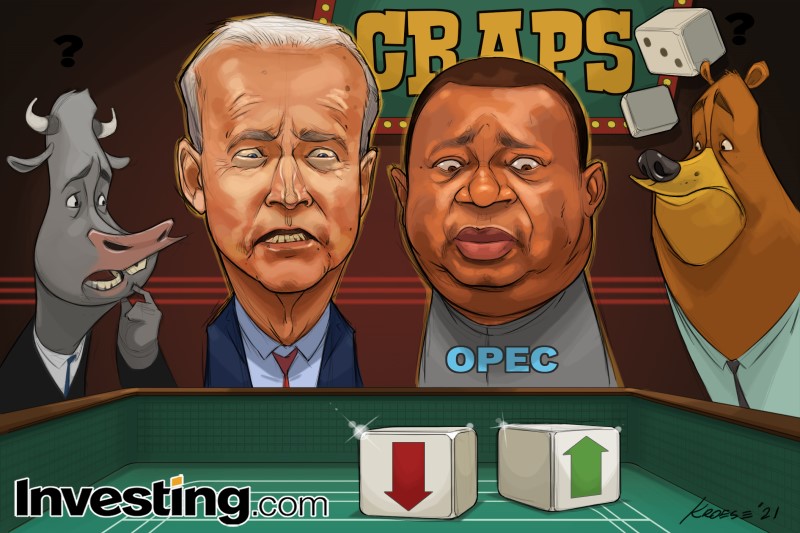

As a result, the production-sharing deal between the world’s big exporters is looking less and less fit for purpose. And with prices at a level that will reward quota-busting, the pretense of cooperation is likely to come under increasing pressure from now on.

On the other side of the table are the world’s major consumers, who are too frightened to withdraw the unprecedented stimulus that they rushed to provide in the first days of the pandemic. With the U.S. economy having ridden out a summer soft patch due to the Delta variant of Covid-19, the world is seeing an almighty boom, especially for goods that all need energy to be produced and delivered.

China, which accounts for 30% of world manufacturing, said its exports rose by a quarter in year-on-year terms in September, as U.S. and European businesses rushed to stock their shelves with consumer goods for the holiday season. Air travel continues to recover (the U.S. reopened its gates to transatlantic travelers as of this week). With such factors in mind, BP (NYSE:BP) estimates that global demand is already back at over 100 million barrels a day.

Which makes the policy-making confusion in the U.S. all the more disconcerting. President Joe Biden is unwilling to encourage oil and gas production in the U.S. due to his green agenda. That leaves him no option but to appeal to OPEC and Russia to pump more – with predictable results.

Biden’s agenda will inevitably make it harder for the U.S. oil industry to perform the role it has played in the last 15 years by also raising output to meet steadily rising global demand. Environmentalists would argue that that is the whole point, after all. But the resulting regulatory uncertainty – and, in some cases, shareholder pressure - will deter both oil and gas producers from investing in future production and will also deter Wall Street from giving them the money to do that (especially after last year’s bond market carnage).

Consequently, despite prices rising to nearly $85 a barrel this month, U.S. producers are barely producing a drop more oil than they did in March. The fact that supply is less elastic than demand has always been a problem for world oil markets, but the point is being rammed home with a vengeance now.

Ultimately, as is always the case, high prices will be the cure for high prices. Demand will be destroyed and substitution to alternative energy sources will accelerate. However, there seems little to stop prices marching higher in the short term. Russel Hardy, the chief executive of the world's largest oil trader Vitol, told an industry conference on Tuesday that $100 a barrel is "certainly a possibility." Russian President Vladimir Putin said much the same last month. It would be a brave person to bet against it.