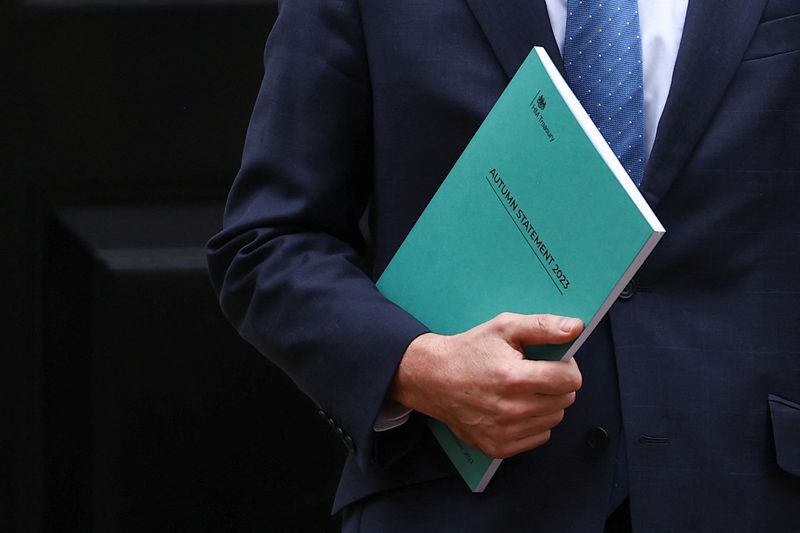

LONDON (Reuters) - Finance minister Jeremy Hunt delivered his Autumn Statement to parliament on Wednesday, setting out tax and spend plans that he hopes will boost Britain's struggling economy ahead of an election expected next year.

Below are the main quotes from Hunt:

GROWTH FORECASTS:

The OBR expects the economy to grow by 0.6% this year and 0.7% next year. After that, growth rises to 1.4% in 2025, then 1.9% in 2026, 2% in 2027 and 1.7% in 2028.

FUTURE DEBT FORECASTS:

Headline debt is now predicted to be 94% of GDP (Gross domestic Product) by the end of the forecast.

The OBR (Office For Budget Responsibility) today forecast underlying debt will be 91.6% of GDP next year, 92.7% in 2024-25, 93.2% in 2026-27, before declining in the final two years of the forecast to 92.8% in 2028-29.

DEFICIT:

According to the OBR, borrowing is lower this year and next, and on average across the forecast by 0.7 billion pounds every year compared to the Spring budget forecasts.

It falls from 4.5% of GDP in 2023-24, to 3.0%, 2.7%, 2.3%, 1.6% and 1.1% in 2028-29. That means we also meet our second fiscal rule - that public sector borrowing must be below 3% of GDP – not just by the final year, but in almost every single year of the forecast.

BUSINESS INCENTIVES

If we are to raise productivity, we need to increase business investment further. In 2021, (Sunak) introduced the super-deduction for large businesses to further stimulate business investment, and this Spring, I introduced “full expensing” for three years.

This means that for every million pounds a company invests, they get 250,000 pounds off their tax bill in the very same year.

Because it costs 11 billion pounds a year, I made clear that I would only (make it permanent) when it was affordable. With inflation halved, borrowing down, and debt falling, today I deliver on that promise. I will today make full expensing permanent. This is the largest business tax cut in modern British history.

EMPLOYEE NATIONAL INSURANCE

I am going to cut the main 12% rate of employee National Insurance.

If I cut it by 1 percentage point to 11%, that would be an extra 225 pounds in the pockets of the average worker every year. But instead, I'm going to go further and cut the main rate of Employee National insurance by 2 percentage points from 12% to 10%. This change will help 27 million people.

BUSINESS RATES REDUCTION

We have frozen the tax rate for the last three years at a cost of 14.5 billion pounds ($18.07 billion). We have removed downwards caps from Transitional Relief.

NATIONAL INSURANCE FOR SELF EMPLOYED

I can announce we are abolishing Class 2 National Insurance altogether, saving the average self-employed person 192 pounds a year.

FISCAL RULES

We therefore meet our fiscal rule to have underlying debt falling as a percentage of GDP in the final year of the forecast, with double the headroom compared to the OBR’s March forecast.

NATWEST

I will explore options for a Natwest (LON:NWG) retail share offer in the next 12 months subject to supportive market conditions and achieving value for money.

ON PENSION RISES:

Today we honour our commitment to the triple lock in full. From April 2024, we will increase the full new state pension by 8.5% to 221.20 pounds a week, worth up to 900 pounds more a year.

ON FREEZING ALCOHOL DUTIES:

I have decided to freeze all alcohol duty until August 1st next year. That means no increase in duty on beer, cider, wine or spirits.