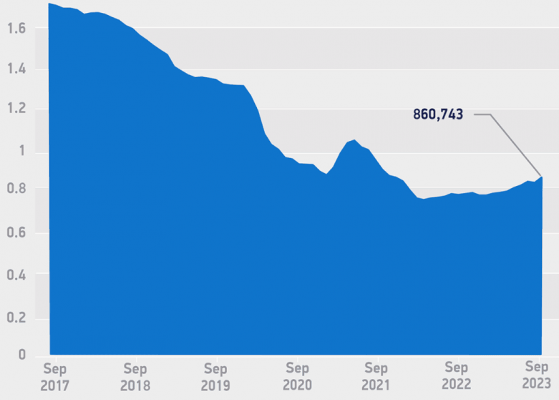

PoundSterlingLIVE - A surge in car exports to the European Union has helped the UK car manufacturing industry report its strongest month of growth so far in 2023. According to the SMMT, UK car manufacturing grew 39.8% in September 2023 with 88,230 units produced in factories across the UK.

The boost was aided by a 32.2% increase in exports, nearly 60% of which were destined for the EU. Deliveries for the UK market surged by 65.9%," says a comment from Renty, a car rental services provider.

Electrified vehicle output rose 41.5% as the sector continued to increase its market share.

"September is a triple success for the sector, with it being the strongest month of growth in 2023, the best September since 2020,1 and UK car making now reaching 659,901 units year to date – some 14.9% above the same period in 2022," says the SMMT.

The EU accounted for 58% of UK car exports in September, with 37,563 cars, up 46.1% on the same time last year.

Looking at the ex-EU market breakdown, car export growth to the U.S. was up 19.8% to 6,591 units, China up 28.2% to 4,776 units and Turkey up 212.0% to 4,162 vehicles.

"A particularly strong period of car making is good news for the UK, given the thousands of jobs and billions of pounds of investment that depend on the sector. With countries around the world shifting to zero-emission motoring, Britain is well placed to be a global EV manufacturing hub if the investment and trading conditions are right," says Mike Hawes, Chief Executive at SMMT.

Hawes does, however, express concern that looming EU rules on rules of origin for car components could stifle the UK's electric vehicle production.

"The increasing importance of electrified car production, the first and urgent step is for the UK and EU to agree to delay the tougher rules of origin requirements that are due imminently. This would give the necessary breathing space for automotive sectors on both sides of the Channel to scale up gigafactories and green supply chains, both of which are essential for a stable, long-term transition," he says.

October saw car manufacturers from across Europe request the European Commission delay the introduction of post-Brexit "rules of origin" rules that they say would hinder the bloc's electric car output.

The car manufacturers are seeking a three-year delay to the imposition of a 10% tariff on exported cars between the UK and EU if the batteries are not sourced within Europe. The majority of electric car batteries are currently produced in China, South Korea and Japan.

The manufacturers say approximately 90% of electric cars exported from the EU to the UK, and vice versa will be impacted by existing rules.

An original version of this article can be viewed at Pound Sterling Live