Investing.com -- Data indicating a cooling in inflationary pressures in the U.S. may be encouraging, but it is still too soon to say if price growth in the world's largest economy is sustainably subsiding, according to Fed Vice Chair Philip Jefferson.

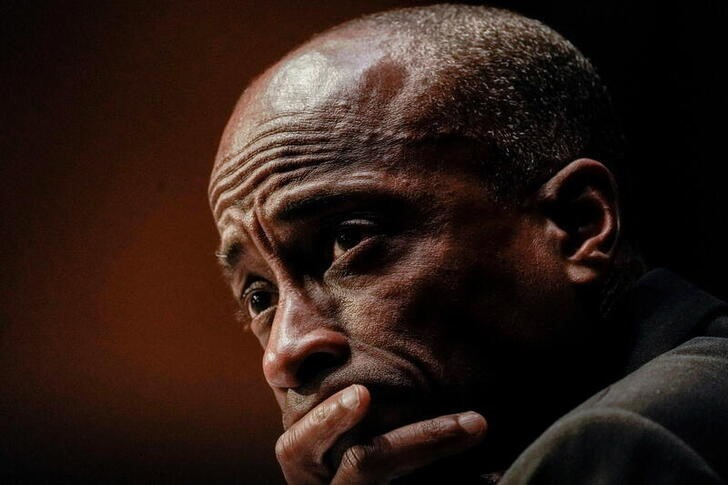

Speaking at an event in New York, Jefferson argued that it is too early to tell if a "disinflationary process" in the U.S. will be long lasting.

"This feels consistent with the idea that the Fed leadership is looking at September as the potential date for the first cut provided that a more definitive and sustained downshift in inflation emerges over the coming months," Evercore ISI economists said in a flash note.

"[W]e view [this] as a necessary condition for the Fed to lift its pause on rate cuts absent a much more severe weakening in the labor market than has appeared to date.

He noted in particular that a large pandemic-era spike in market rents is still being passed through to existing rents and may keep housing services inflation elevated for longer.

Jefferson added that he will be carefully assessing incoming economic figures, but did not say if he will be supporting cuts to interest rates later this year.

His comments were similar to sentiments voiced by Fed colleagues Raphael Bostic and Michael Barr elsewhere on Monday. Both officials stressed that they would still need to see more evidence that inflation is slowing back down to the Fed's stated 2% target before embarking on bringing down interest rates from more than two-decade highs.

The Fed's preferred inflation gauge, the Personal Consumption Expenditures price index, registered 2.7% in March. The April data will be published next week.

Senad Karaahmetovic contributed to this report.