(Bloomberg) -- Want the lowdown on European markets? In your inbox before the open, every day. Sign up here.

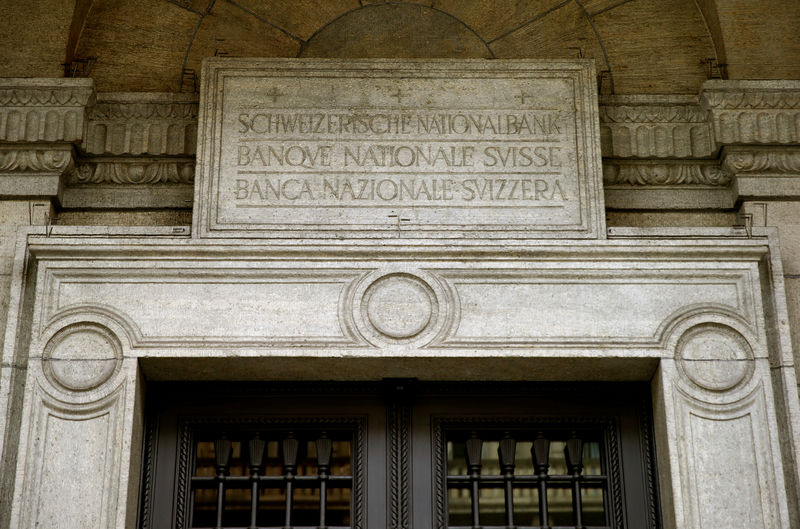

The Swiss National Bank will probably face even more criticism of its sub-zero interest rates, lessening the likelihood of policy being eased further, according to Deloitte.

“Political disputes over the interest rate policy are likely to intensify further -- both in Switzerland in the euro zone,” said Michael Grampp, chief economist at Deloitte Switzerland. Companies, not just banks, are increasingly airing the view that the negative policy benchmark was hurting rather than helping the economy, he said.

The SNB’s deposit rate has been at -0.75% for almost five years, designed to keep the franc from appreciating. While machine-makers say the negative rates are welcome, the policy has been criticized by the financial sector for crimping returns.

Newspaper SonntagsZeitung reported this weekend that insurance companies, including Baloise Holding AG and Zurich Insurance Group AG, were seeing increased demand for cash storage.

Based on criticism, the SNB “won’t pull a 180, but I personally doubt there will be an intensification” of the negative rates, Grampp said.