By David Randall

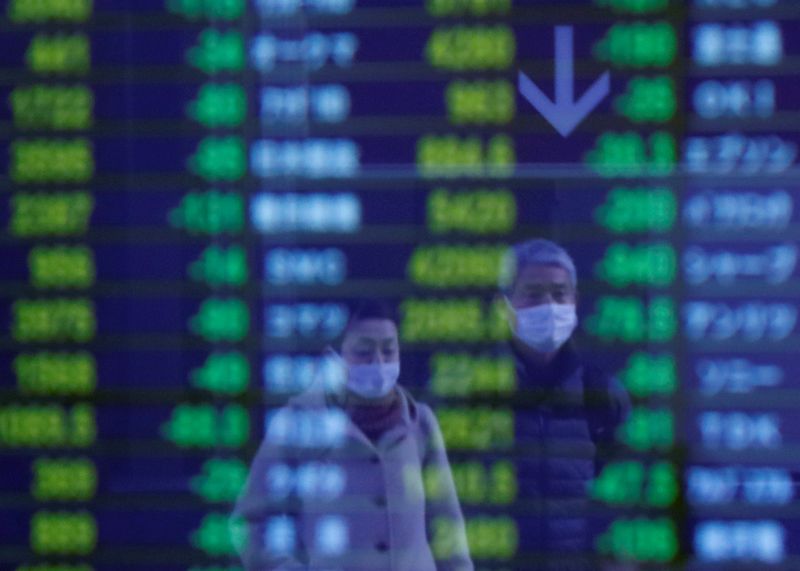

NEW YORK (Reuters) - World equity markets climbed on Thursday on the back of a surge in risky assets like oil, offsetting concerns over an increasing death toll from the coronavirus pandemic that is expected to push the global economy into a recession.

Investors sought the safety of the U.S. dollar and government bonds. Oil futures were among the few risk assets that advanced, with benchmarks surging 25% after U.S. President Donald Trump said he expected Saudi Arabia and Russia to reach a deal soon to end their oil price war.

MSCI's gauge of stocks across the globe (MIWD00000PUS) rose 0.85% after broad declines in Europe and Japan. European shares lost their early gains after data showed weekly jobless claims in the U.S. jumped to a record 6.6 million, double the record from the previous week.

In midday trading on Wall Street, the Dow Jones Industrial Average (DJI) rose 331.67 points, or 1.58%, to 21,275.18, the S&P 500 (SPX) gained 44.11 points, or 1.79%, to 2,514.61 and the Nasdaq Composite (IXIC) added 110.17 points, or 1.5%, to to 7,470.75.

"The rise is unprecedented, what it tells us is that the U.S. economy is going into a full sudden stop," said Gennadiy Goldberg, interest rate strategist at TD Securities in New York.

"Markets have to digest the fact that all the workers being laid off, while they are still receiving some added assistance from the government, they are not going out and still not spending, so they are still not adding to GDP."

Investors sought the perceived safety of government bonds. Benchmark U.S. 10-year notes (US10YT=RR) last rose 11/32 in price to yield 0.6017%, from 0.635% late on Wednesday.

The World Health Organization said the global case count would reach 1 million and the death toll 50,000 in the next few days. It currently stands at 46,906.

U.S. President Donald Trump, who had initially played down the outbreak, told reporters at the White House on Wednesday that he is considering a plan to halt flights to coronavirus hot zones in the United States.

In currency markets, the dollar stood rose 0.652% against a basket of six major currencies (=USD) after a gain of 0.53% overnight. The euro traded down 1% at $1.0852 as the dollar advanced.

Brent crude (LCOc1) futures jumped 25% to $30.84. U.S. West Texas Intermediate (WTI) crude (CLc1) futures soared 25% to $25.39.

Trump said he had talked recently with the leaders of both Russia and Saudi Arabia and believed the two countries would make a deal within a "few days" to lower production and thereby bring prices back up.