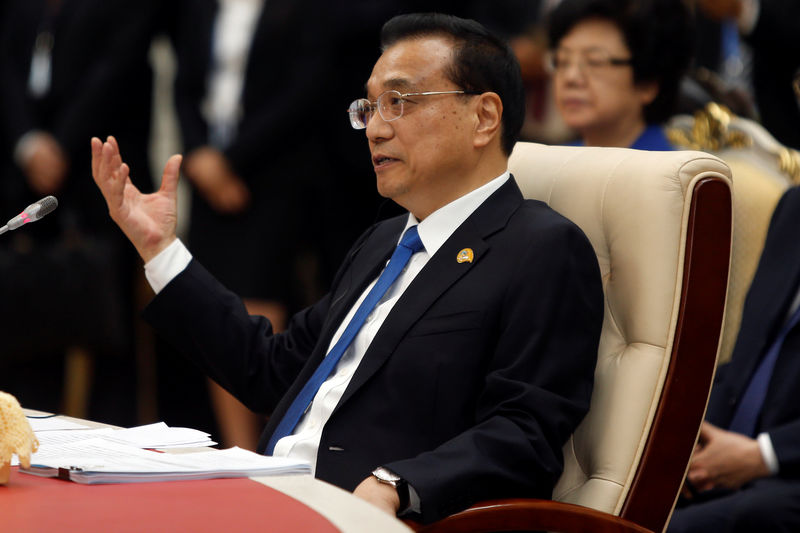

BEIJING (Reuters) - China's Premier Li Keqiang has called for more targeted economic policies and measures to cope with structural changes in the world's second-largest economy.

His comments come after China reported growth of 6.9 percent in 2017, compared with its target of about 6.5 percent.

The economy beat the government's expectations, reflecting quantitative expansion as well as an improvement in the quality of growth, Li told economic experts and entrepreneurs in a closed-door meeting on Monday.

A statement on the meeting, published by the central government on its website late on Tuesday, did not include any specifics on how policy might be changed.

In recent years, China has been cutting excess capacity in heavy industries as part of its so-called supply-side reforms while pushing for new growth drivers, such as technology, and moving up the value chain.

But policymakers walk a fine line as they shutter polluting and idle factories without causing massive unemployment and stunting local economies.

Authorities' efforts to contain financial risks and slow a build-up in corporate debt have added a layer of complexity in China's economic transformation.

The central bank has so far refrained from raising benchmark policy interest rates to rein in risks, choosing instead to nudge up money market rates incrementally. Any broad monetary policy tightening could risk destabilising economic growth, economists say.

"We should increasingly rely on reform, opening up and innovation to propel transformation and foster new economic drivers," Li said at the meeting on Monday.

The meeting was held to gather opinions on the annual government work report scheduled to be published in March.

FAW Group [SASACJ.UL] Chairman Xu Liuping said at the meeting that China should expedite mixed-ownership reform in state-owned enterprises.

Zhang Shiping, chairman of Shandong Weiqiao Pioneering Group [SDWQP.UL], said stable policies can stimulate private investment, while Morgan Stanley (NYSE:MS) economist Robin Xing said China should tap the potential of small cities to drive consumption.