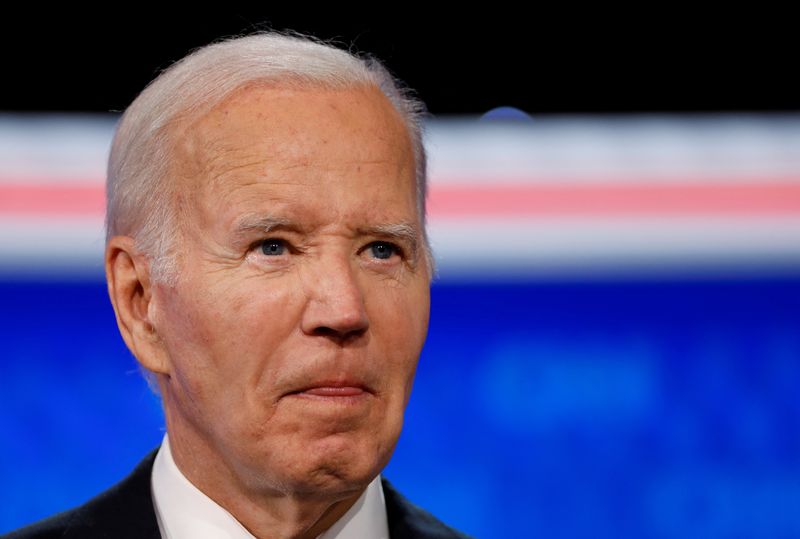

Investing.com - President Biden is gearing up to announce a policy proposition that would place a 5% cap on rental increases across the nation.

This proposed policy, if actualized, is likely to impact large apartment Real Estate Investment Trusts (REITs) such as AvalonBay Communities Inc (NYSE:AVB), Equity Residential (NYSE:EQR), and Camden Property Trust (NYSE:CPT), along with certain multifamily lenders.

Analysts from BTIG, however, suggest this announcement leans more towards political posturing than pragmatic policy, as it necessitates an act of Congress, an occurrence that appears unlikely in the foreseeable future.

The proposed policy aims to eliminate a tax benefit for landlords who raise the rent on a certain number of properties by more than 5% annually. The policy would apply to landlords who own over 50 units, which, according to White House estimates, make up about half of the rental market. If enacted, the plan would be in effect for two years.

However, BTIG analysts assert that this should be seen more as a political maneuver rather than an actionable policy. Historically, rent control has been unsuccessful both as a concept and in practice. Even in a scenario where Democrats control both the presidency and Congress, the chances of passing rent control remain exceptionally low.

The experience of St. Paul, Minnesota, serves as a cautionary tale in the realm of rent control. In November 2021, voters approved a 3% cap on annual rent increases among other provisions. This led to a considerable decline in investment, reflected in a significant decrease in residential building permits.

In stark contrast, Minneapolis, St. Paul's twin city, saw a nearly 68% increase in multifamily permitting following the implementation of St. Paul's rent control standard.

The Federal Housing Finance Agency (FHFA) announced a set of required tenant protections for properties financed by either Fannie Mae or Freddie Mac. These policies, which include a 30-day written notice of rent increases, a 30-day written notice of a lease expiration, and a 5-day grace period for rent payments, are set to be effective on February 28, 2025.

From an industry perspective, BTIG analysts believe that this is the best-case scenario as the required policy changes are manageable and far less disruptive than other proposals, like rent increase caps.

On the other hand, UBS analysts suggest that if the goal is to reduce the cost of housing, be it ownership or rental, a more effective solution would be to increase the supply of single and multifamily units. Rent control, in their view, could exacerbate the ongoing housing shortage and ultimately lead to even higher housing costs.

Statewide rent control has been implemented in several states, and numerous other states and municipalities are examining potential rent control policies.

While the demographic forces and long-term supply/demand fundamentals are attractive for rental housing, UBS analysts warn of the looming political and regulatory risks.