(Reuters) - Britain's markets regulator and a group of global banks are in talks to reach a first settlement in a currency-rigging probe, with a deal possible this year, Bloomberg reported.

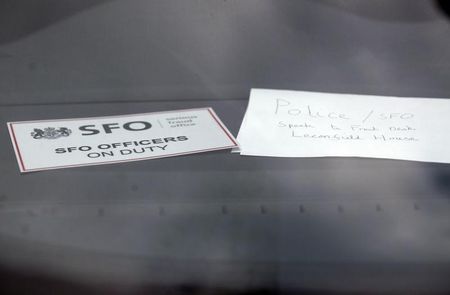

Meanwhile, Britain's Serious Fraud Office told Reuters on Wednesday that prosecutors could charge the first individuals in connection with a global investigation into alleged manipulation of currency markets as soon as next year.

Bloomberg reported the Financial Conduct Authority (FCA) was in talks with banks, including Barclays Plc (L:BARC), Citigroup Inc (N:C), JPMorgan Chase & Co (N:JPM) and UBS AG (VX:UBSN) (N:UBS), citing sources who asked not to be identified. (http://bit.ly/UtbbSM)

The FCA declined to comment on the Bloomberg story.

Royal Bank of Scotland Group Plc (L:RBS) and HSBC Holdings Plc (L:HSBA) may also be part of the group settlement, according to the sources.

Three of the sources told Bloomberg the FCA was trying to fast-track the process and may levy fines in the coming months. Two sources said the regulator was seeking to keep the scope narrow to speed up a settlement.

The talks were continuing and an agreement may stretch into next year, the sources told Bloomberg.

The FCA launched its probe last October, and the Bank of England appointed barrister Anthony Grabiner in March to examine whether any of its officials were involved in foreign exchange rigging.

(Reporting by Aashika Jain in Bangalore; Editing by Jeffrey Benkoe)

2_800x533_L_1412520354.jpg)