By Lucia Mutikani

WASHINGTON (Reuters) - New orders for key U.S.-made capital goods surged in June, but the jump will probably not change expectations that business investment contracted further in the second quarter and contributed to holding back the economy.

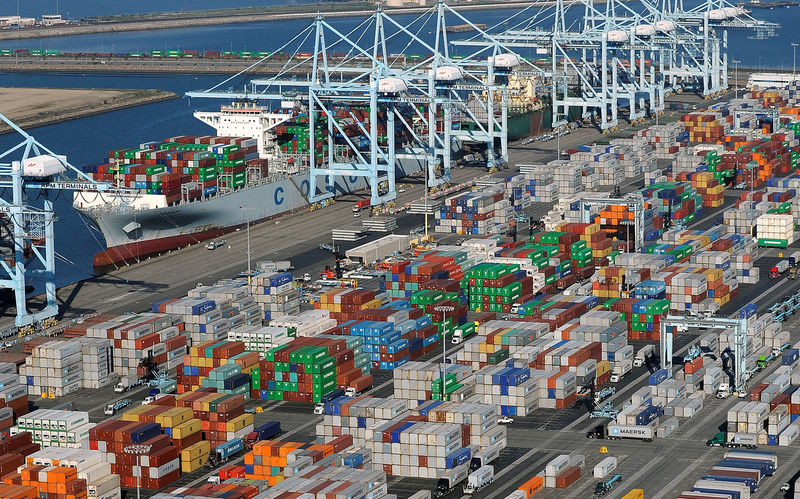

Other data on Thursday showed the goods trade deficit narrowed last month as imports and exports declined, suggesting the trade war between the United States and China was hurting the flow of trade. Inventories slowed sharply, indicating stock accumulation was a drag on economic growth in the last quarter.

Business investment and housing have been flagged by the Federal Reserve as areas of weakness in the economy. The U.S. central bank is expected to cut interest rates next Wednesday for the first in a decade.

The Commerce Department said orders for non-defence capital goods excluding aircraft, a closely watched proxy for business spending plans, jumped 1.9% last month. Orders in June increased across the board, with demand for machinery rising by the most in nearly 1-1/2 years.

Data for May was revised lower to show these so-called core capital goods orders gaining 0.3% instead of rising 0.5% as previously reported. Economists polled by Reuters had forecast core capital goods orders would climb 0.2% in June.

Core capital goods orders rose 1.9% on a year-on-year basis. Shipments of core capital goods increased 0.6% last month after a downwardly revised 0.5% rise in the prior month. Core capital goods shipments are used to calculate equipment spending in the government's gross domestic product measurement.

They were previously reported to have increased 0.6% in May.

June's surge in core capitals goods suggests a pickup in business spending on equipment, which contracted in the January-March quarter for the first time in three years.

Fed Chairman Jerome Powell early this month described business investment as appearing to have "slowed notably" and said this might "reflect concerns about trade tensions and slower growth in the global economy."

U.S. stock index futures were unchanged after the release of the data, while the dollar slightly trimmed losses against the yen. Prices of U.S. Treasuries were trading lower after giving up earlier gains.

STRONG LABOUR MARKET

In a second report on Thursday, the Commerce Department said the goods trade deficit fell 1.2% to $74.2 billion (£59.4 billion) in June, with imports dropping $4.6 billion to $210.5 billion last month. Exports fell $3.7 billion last month to $136.3 billion.

It also said wholesale inventories rose 0.2% after increasing 0.4% in May. Stocks at retailers fell 0.1% last month following a 0.3% rise in May.

The government will publish its snapshot of second-quarter GDP on Friday. According to a Reuters survey of economists, GDP likely increased at a 1.8% annualised rate in the April-June quarter, moderating from the first quarter's brisk 3.1% pace.

Weak business investment has combined with an inventory overhang and design problems at Boeing (N:BA) to undercut manufacturing, which accounts for about 12% of the economy.

The manufacturing sector's woes were highlighted by Caterpillar (N:CAT), which on Wednesday reported earnings below Wall Street's estimates and said its full-year profits were expected to be at the lower end of its earlier forecast.

Boeing also reported its biggest-ever quarterly loss on Wednesday due to the spiralling cost of resolving issues with its 737 MAX and warned it might have to shut production of the grounded jet completely if it runs into new hurdles with global regulators to getting its best-selling aircraft back in the air.

The single-aisle plane was grounded worldwide in March after two fatal crashes in Ethiopia and Indonesia. Production of the aircraft has been reduced and deliveries suspended.

In June, orders for machinery jumped 2.4%. There were also increases in orders for computers and electronic products, primary metals, and electrical equipment, appliances and components.

Overall orders for durable goods, items ranging from toasters to aircraft that are meant to last three years or more, increased 2.0% in June, the most since August 2018, after declining 2.3% in the prior month.

Orders for transportation equipment rose 3.8% after falling 7.5% in May. Motor vehicles and parts orders increased 3.1% last month. Orders for non-defence aircraft soared 75.5%.

Boeing reported on its website that it had received nine aircraft orders in June after getting no orders in May

Still, the economy continues to be supported by a strong labour market. In a third report on Thursday, the Labour Department said initial claims for state unemployment benefits dropped 10,000 to a seasonally adjusted 206,000 for the week ended July 20, the lowest level since mid-April.

Economists polled by Reuters had forecast claims would increase to 219,000 in the latest week.