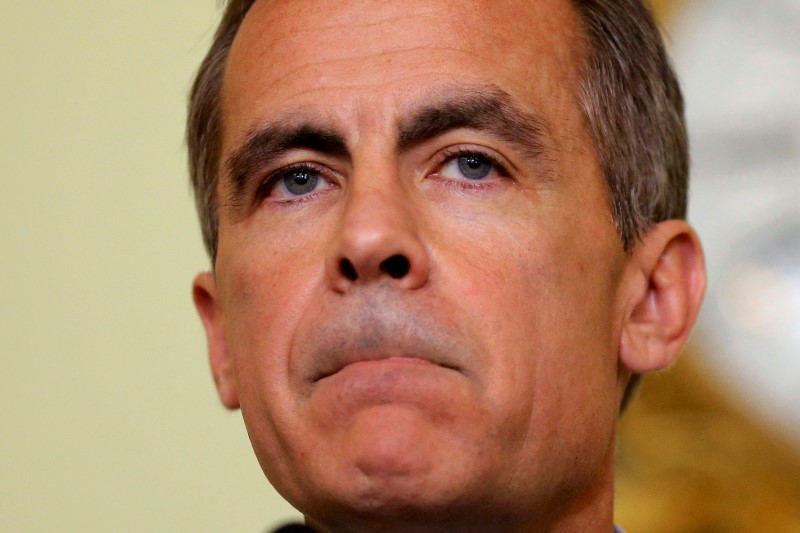

LONDON (Reuters) - Consumer lending in Britain rebounded in August and rose by the largest amount in three months, Bank of England figures showed on Friday, shortly after Governor Mark Carney said banks had been lending too much.

Consumer credit increased by 1.583 billion pounds last month, compared with a rise of 1.166 billion pounds in July. A Reuters poll of economists had pointed to a reading of 1.35 billion pounds.

Earlier on Friday Carney said there was no overall debt bubble in Britain but that the BoE was worried about "a pocket of risk" in consumer debt that has been growing at about 10 percent a year.

"We think banks have been giving too much credit ... and not been as disciplined as they should be in their under-writing standards and their pricing on this debt," he told BBC radio.

Consumer lending was 9.8 percent higher in August than a year ago, Friday's figures showed, the same growth rate as in July.

The BoE said on Monday that British banks have underestimated risks from their lending to consumers and need to hold an extra 10 billion pounds of capital to guard against the risk of future losses.

Other figures from the BoE showed Britain's housing market slowed last month.

The number of mortgages approved for house purchase fell to 66,580 from 68,452 in July, below economists' forecasts of a drop to 68,000 in a Reuters poll.

Still, August's fall put mortgage approvals roughly in line with the BoE's expectation that they will average around 66,000 a month over coming quarters.

Figures this week from industry group UK Finance showed growth in consumer credit slowed in August while mortgage approvals picked up slightly.

Britain's economy had its slowest first half the year since 2012, as consumers came under pressure from a big rise in inflation following the fall in sterling caused by last year's Brexit vote.