By Padraic Halpin

DUBLIN (Reuters) - Ireland's government expects the economy to grow by around 6 percent this year, far more than originally forecast, after data on Thursday showed that it grew by 1.9 percent quarter-on-quarter from April to June.

After growing by more than 5 percent in 2014, Ireland was already set to be the best performing economy in Europe for the second successive year when the government forecast in April that it would grow by 4 percent this year.

The strong second quarter followed upwardly revised growth of 2.1 percent in the first three months and put gross domestic product (GDP) 6.7 percent ahead of the second quarter a year ago, the Central Statistics Office (CSO) said. That was close to the 7 percent growth China posted in the second quarter.

"If you get 7 percent in the first half of the year, if the economy didn't grow at all in the second half, you'd still have 5.7 by year end," Finance Minister Michael Noonan told reporters.

"Of course the economy is growing very strongly in the third quarter so somewhere around 6 (percent), slightly below, slightly above for the 2015 figure."

Ireland's debt to GDP ratio will fall below 100 percent by year-end as a result, rather than in 2016 as initially expected, Noonan said. Ireland's debt peaked at 125 percent of GDP in 2013 as it completed a three-year bailout programme taken after a burst property bubble wrecked its economy and banking sector.

"The underlying picture is that the natural bounce-back in the economy has been accentuated by the weak euro stimulating exports, and low oil prices and tax cuts helping real incomes," said Davy chief economist Conall Mac Coille, describing the growth rates as "exceptionally strong".

European Central Bank stimulus has weakened the euro currency while its asset purchases have also helped Irish bond sales: the country's debt agency sold 1 billion euros of 15-year debt on Thursday at a near record low yield of 1.8 percent.

Between April and June, exports rose 5.4 percent quarter-on-quarter, while typically volatile investment spending grew 19.2 percent. Personal consumption was up 0.4 percent, although retail sales data in July suggest a sharp pick up ahead.

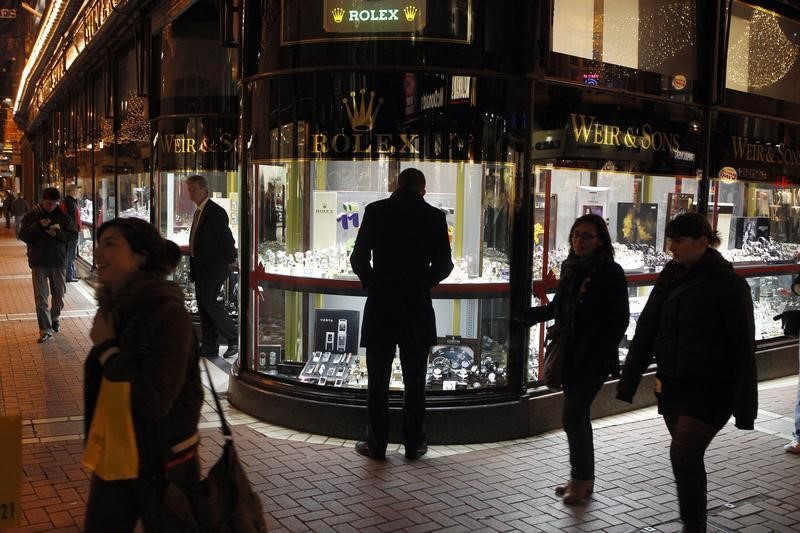

Despite the strong momentum, many Irish people are still grappling with the legacy of the economic crash.

Household debt levels are second only to the Netherlands within the euro zone and more than one-in-eight mortgages is in arrears. Rents in Dublin are meanwhile almost back to their pre-crisis peaks, pushing up the cost of living.

Noonan will unveil his 2016 budget next month, the last before elections due next year. He said on Thursday he needed to bring down personal taxes, provide relief on childcare and do more for the 9.5 percent of workers still unemployed.

"It's definitely not getting to the ground and we're certainly not seeing it. People on middle incomes haven't got the cash in their pockets," said John, a supermarket owner who declined to give his surname.

"People have legacy debt and are trying to get themselves together. Certainly on the domestic economy, it's very, very tough."