Proactive Investors - The latest KPMG and REC, UK Report on Jobs survey, compiled by S&P Global, showed that labour shortages and concerns over the economy hit recruitment in November.

The monthly index of demand for staff fell in November to 54.1 from 56.7 in October, the lowest reading since February 2021.

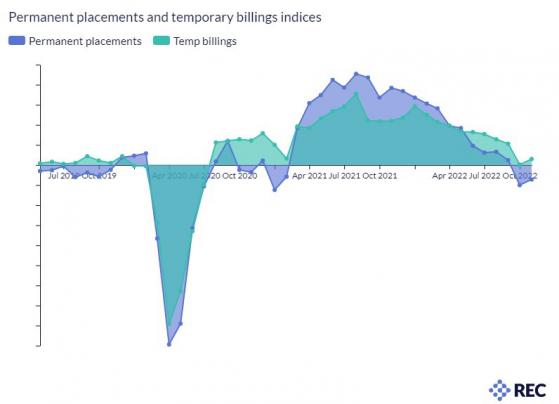

The survey showed that permanent placements fell for the second consecutive month, temp billings rose only modestly while overall vacancies expanded at the softest pace for 21 months.

Candidate supply remained historically low and competition for scarce workers and the rising cost of living continued to push up starting salaries.

Pay increases also showed signs of moderating with the latest increase in permanent starters' pay the least marked since April 2021, while temp pay growth moderated to an 18-month low.

Commenting on the latest survey results, Neil Carberry, chief executive of the REC, said: “This month’s data emphasises that while employers are moderately more cautious in the face of economic uncertainty, this is not yet a major slowdown in hiring.”

“While permanent recruitment activity has dropped from the very high levels of earlier in the year, the pace of that drop has tempered this month.”

"As the economic outlook weakens, we can expect to see falls from historic highs across our measures, but it is notable that pay and vacancies are still growing, although at a much lower rate.”

Read more on Proactive Investors UK