By Atul Prakash

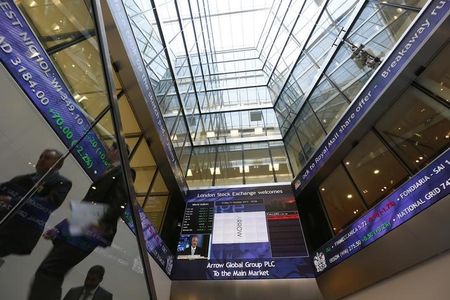

LONDON (Reuters) - Britain's top share index edged higher on Tuesday, with focus shifting to economic data and comments from central bankers for clues to the market's next moves.

The blue-chip FTSE 100 index was up 0.2 percent at 6,760.34 points by 0907 BST after closing 0.8 percent higher on Monday. The index fell to a 2 1/2-month low earlier this month, the recovered slightly.

Investors were looking to UK inflation data, Germany's ZEW sentiment index and U.S. retail sales numbers on Tuesday. Bank of England Governor Mark Carney and U.S. Federal Reserve Chair Janet Yellen were also scheduled to speak.

"Expected comments from central bankers remain front and centre, whilst a number of scheduled U.S. corporate results later today are also likely to provide direction to the market," said Keith Bowman, equity analyst at Hargreaves Lansdown.

"However, with central bankers still standing squarely behind markets, few alternatives to equities appealing and early second-quarter U.S. corporate results beating expectations, any weakness is likely to be seen as a buying opportunity."

Carney and members of the Financial Stability Committee will appear in front of parliament's Treasury Committee. Last month, the bank imposed its first limits on how much most people can borrow to buy a home, in a bid to stem increasing levels of debt and rapidly rising house prices.

Yellen will testify on Fed policy before the Senate Banking Committee. Analysts at Societe Generale expected Yellen to keep her recent, dovish tone of despite improvements in labour market conditions and housing activity.

"Given the still elevated dependency on accommodative policy Yellen's testimony will be watched very closely. Data may optically be telling us that a recovery in the U.S. is under way but the underlying picture is incredibly weak," Jeremy Batstone-Carr, head of private client research at Charles Stanley, said.

Tuesday's gains were led by basic resources stocks. The UK mining index rose more than 1 percent on expectations that a gradual global economic recovery will improve demand for metals.

Global miners Rio Tinto and BHP Billiton Anglo American rose 1.6 percent and 1.4 percent respectively, while Anglo American was up 1.6 percent.

(Reporting by Atul Prakash; Editing by Larry King)