Levered Bets on Bitcoin Go Both Ways Good news for an underlying commodity tends to be even better news for companies that mine it, all else equal, thanks to their inherent operational leverage. Frank Holmes explained the concept using gold miners as an example, in an article a few years back:

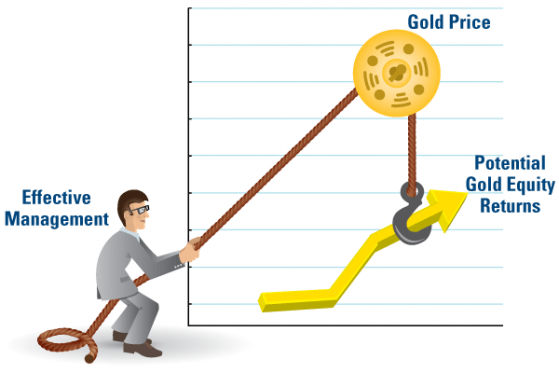

The upside to gold stocks is that investors historically have received a 2-to-1 leverage by owning gold equities instead of the commodity. [...]A similar phenomenon appears to be at work with bitcoin and bitcoin miners. For example, from June 10th of last year to November 9th of last year, Bitcoin climbed 82%.Picture the gold price as a pulley with gold company executives applying force on one side of a rope. The more disciplined and successful the management, the bigger the potential boost in gold equity returns.

The muscle that gold miners can use to increase their "multiplier effect" for shareholders is three fold: Grow production volume, expand margins or optimize capital.

Over the same time period, the bitcoin miner Marathon Digital Holdings, Inc. (NASDAQ: MARA) was up 184%.

Every day the market's open, our system gauges underlying price action and options market sentiment to pick the securities it estimates will perform best over the next six months. Those are were its top ten names on June 10th.

While June 10th of last year turned out to be a good time to buy bitcoin, and MARA, November 24th turned out to be a terrible time for both. Bitcoin was down 48% over the next six months, while MARA was down nearly 83%.

What Happens When Your Bitcoin Miner Tanks More Than 80% Here's where it gets interesting. Marathon Digital appeared in one of our hedged portfolios on November 24th of last year, along with the ProShares Ultra Bloomberg Natural Gas ETF (ARCA:BOIL).

Screen capture via Portfolio Armor on 11/24/2021.

For larger portfolios, our system includes more underlying securities, but for $30,000 portfolios like that one, it aims for two primary securities, which, in this case, were MARA and BOIL. After starting with equal dollar amounts of each, our system rounded each down to round lots (to reduce hedging cost), and then put most of the leftover cash from the rounding down process into a more tightly hedged BOIL position.

Here's how that portfolio did over the next six months.

Despite MARA being down over 80%, the hedged MARA position was only down about 11%. Overall, the portfolio was up 10.35% over the next six months, while the SPDR S&P 500 ETF (SPY (NYSE:SPY)) was down 15.54% over the same time period, so it beat the market by more than 25 points.

Would have done even better without the bitcoin miner, of course, but that's pretty good, considering.

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga