Benzinga - To gain an edge, this is what you need to know today.

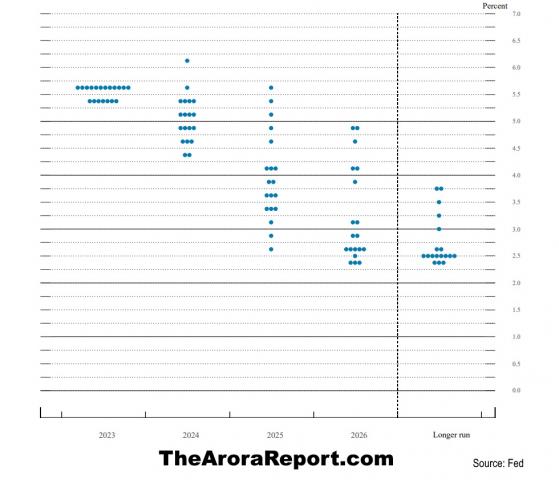

Dot Plot Please click here for the Fed’s new dot plot.

Note the following:

- We previously shared with you that the most important information ahead was the new dot plot. That call has proven spot on. The new dot plot is hitting the stock market with significant selling.

- The dot plot shows each FOMC participants’ projected midpoint of the target for the federal funds. Each dot represents an FOMC participant.

- The dot plot shows the highest 2024 projection of 6.125% and the lowest projection of 4.375%.

- The median projection for 2024 is now 5.1% vs. 4.6% from the prior dot plot that we previously shared with you. Please click here to see the prior dot plot.

- The dot plot shows the highest projection for 2025 of 5.625% and the lowest projection of 2.625%.

- The message from the dot plot is that interest rates are going to stay higher for longer. This flies right in the face of projections from momo gurus who have been predicting four rate cuts next year to run up the stock market.

- In The Arora Report analysis, the dot plot shows one to two rate cuts next year.

- The stock market has been running up as the majority of market participants have bought into the no landing scenario which is even better than the soft landing scenario. However, Powell is not willing to endorse either the no landing or the soft landing scenario. From yesterday’s Afternoon Capsule:

Powell says that a soft landing is the primary objective of the Fed. However, when Powell was prompted to say that a soft landing was a baseline expectation, Powell specifically said that a soft landing is not a baseline expectation.In plain English, baseline expectation means the most likely scenario.

- The dot plot is in line with The Arora Report projections that have been used in determining the protection band. For this reason, The Arora Report members are already ahead of the game and no action is needed at this time.

- There is significant uncertainty ahead. Prudent investors should start with Arora’s Second Law of Investing and Trading, which states “Nobody knows with certainty what is going to happen next in the markets.” Follow with Arora’s Third Law, which states “Making investing and trading decisions based on probabilities is the only realistic and profitable approach.” To learn all of Arora’s 30 Laws, please click here.

- In The Arora Report analysis, here are the probabilities:

- Recession 45%

- Soft landing 35%

- No landing 20%

- It is important for investors to keep in mind that the stock market is priced for no landing and zero percent probability of a recession.

- Initial jobless claims this week are a shocker. The jobs picture is stronger than expected. Initial claims came at 201K vs. 225K consensus. Initial claims is a leading indicator and carries heavy weight in our adaptive ZYX Asset Allocation Model with inputs in ten categories. In plain English, adaptiveness means that the model changes itself with market conditions. Please click here to see how this is achieved. One of the reasons behind The Arora Report’s unrivaled performance in both bull and bear markets is the adaptiveness of the model. Most models on Wall Street are static. They work for a while and then stop working when market conditions change.

- As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents. Please scroll down to see the protection band.

England The Bank of England (BoE) left its rates unchanged. The decision was five to four. This indicates tension within the BoE.

Magnificent Seven Money Flows In the early trade, money flows are negative in Apple Inc (NASDAQ: AAPL), Amazon.com, Inc. (NASDAQ: AMZN), Alphabet Inc Class C (NASDAQ: GOOG), Meta Platforms Inc (NASDAQ: META), Microsoft Corp (NASDAQ: MSFT), NVIDIA Corp (NASDAQ: NVDA), and Tesla Inc (NASDAQ: TSLA).

In the early trade, money flows are mixed in SPDR S&P 500 ETF Trust (ARCA:SPY) and Invesco QQQ Trust Series 1 (NASDAQ: QQQ).

Momo Crowd And Smart Money In Stocks The momo crowd is buying stocks in the early trade. Smart money is