Benzinga - Deposits at SMALL banks fell $119 billion the second week of March. And deposits at LARGE banks increased by $67 billion the same week.

Capital and power concentrating at the top.

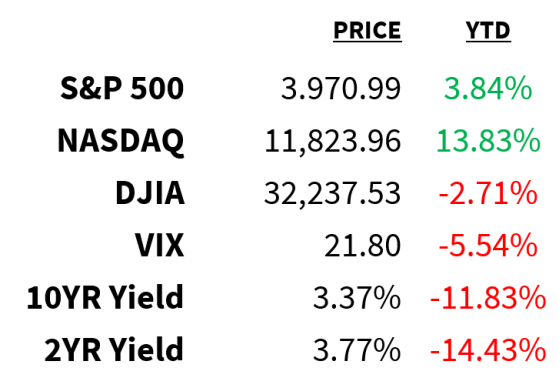

Market

Prices as of 4 pm EST, 3/24/23

Macro

- The FDIC has found a suitor for Silicon Valley Bank (NASDAQ: SIVB). First Citizens will buy $72 billion of the troubled lender’s assets at a $16.5 billion discount. The FDIC will receive equity appreciation rights from First Citizens and retain receivership for some $90 billion in securities and other assets.

- In an interview over the weekend, Minneapolis Fed President Neel Kashkari warned the recent banking turmoil “definitely brings us closer” to a recession. While he didn’t provide any hints as to what this could mean for the upcoming interest rate decision, he noted that solid capital and strong liquidity have kept the banking system resilient.

- Meanwhile, bond yields are rising as markets consider what the latest development in the delicate banking system means for future monetary policy. The spread between the US 2- and 10-year bonds—which has experienced its deepest inversion since 1981—is steepening with investors increasingly expecting the Fed to cut rates.

Stocks

- Despite its rescue last week by UBS, Credit Suisse (NYSE: CS) may still face disciplinary action from Switzerland’s financial regulator. While no probes have been launched, Finma President Marlene Amstad highlighted the lender’s “cultural problem” and said the agency was exploring its options for addressing it.

- After disappearing from the public eye in 2020 following critical remarks aimed at Chinese regulators, Jack Ma is reportedly back in China. Ma’s return comes as Beijing’s crackdown on tech eases and suggests that the uncertainty surrounding the private sector may be dissipating.

- Shifting our attention back to the US banking sector–where stocks have been pummeled in recent weeks–shares of regional banks are surging this morning. The news of Silicon Valley Bank’s sale has presumably brought an air of much-needed stability to the space which has lost more than a quarter of its value this month.

Energy

- As prices for crude oil head for their worst Q1 loss since 2020, Goldman Sachs isn’t the only Wall Street bank cutting its forecast. While some suggest an increase in demand from China and lower Russian production may boost prices in the coming quarters, JPMorgan points to uncertainty over OPEC production cuts and a current surplus as drivers it says could pull prices below $60 a barrel.

Earnings BioNTech (NASDAQ: BNTX)

- H World Group (NASDAQ: HTHT)

- Carnival (NYSE: CCL)

- PVH Corp (NYSE: PVH)

News

- Twitter: Elon Musk sent an email to employees warning Twitter remained in a delicate financial position and offered them new equity grants that value the company–which you may recall he purchased for $44 billion–at $20 billion.

- Nickel: More than a year after trading was suspended and billions of dollar worth of deals were canceled following a short squeeze, nickel has resumed trading on the London Metal Exchange (LME).

- Gold: March is on track to see the first net inflows into gold ETFs in 10 months.

- Safety: US money market funds have seen more than $286 billion in inflows this month, the most since the height of the pandemic.

- Resignation: Ammar al-Khudairy, who is chair of Saudi National Bank and whose comments earlier this month accelerated fears of Credit Suisse’s demise, is resigning due to personal reasons.

Week Ahead

- Monday: Dallas Fed manufacturing

- Tuesday: Retail & wholesale inventories, Case-Shiller home prices, CB consumer confidence

- Wednesday: Pending home sales

- Thursday: Q4 GDP growth, corporate profits, initial jobless claims

- Friday: PCE, personal income & spending, Chicago PMI, consumer sentiment

Crypto

Prices as of 4 pm EST, 3/24/23

- USDT: Already the largest stablecoin in the world, Tether (USDT/USD) has extended its market share lead after a $5 billion influx over the past 2 weeks.

- Oops: On Friday, an NFT trader mistakingly sent a $129,000 CryptoPunk to a burn address, effectively destroying the asset.

- HODL: The number of addresses holding more than 1 Bitcoin (CRYPTO: BTC) has reached a new all-time high of close to 1 million.

- Euler: Blockchain data revealed that the Euler Financial hacker has returned nearly $90 million to the protocol.

- Banking: As the industry finds itself in dire need of banking services, some regional banks–like Customers Bancorp and Fifth Third–have expressed their willingness to bank crypto firms.

Deals

- Cinemas: Private equity firm CVC Capital Partners is exploring a takeover of British cinema operator Cineworld Group.

- LNG: A group led by Brookfield Asset Management has agreed to buy Australian utility Origin Energy in a $12.4 billion deal.

- IKEA: A Russian special purpose vehicle, Invest Plus, is nearing a deal to buy IKEA’s largest Russian factory.

- Brady: Freshly retired NFL star Tom Brady has become a part owner of the WNBA’s Las Vegas Aces.

- Data: Brookfield Asset Management is close to a $3.8 billion acquisition of data center operator Data4.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga