Benzinga - To gain an edge, this is what you need to know today.

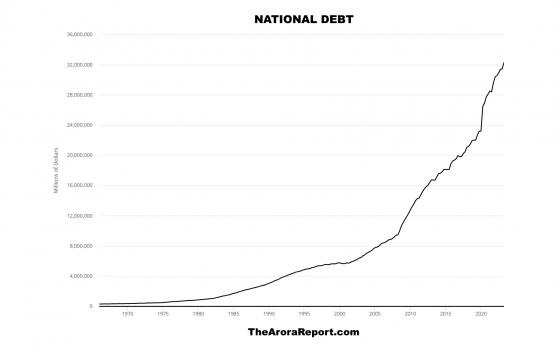

A Terrible Milestone Reached Please click here for a chart of U.S. national debt.

Note the following:

- The chart shows the accelerating trajectory of the U.S. national debt.

- The Treasury Department is informing that for the first time, gross national debt has exceeded $33T.

- The chart shows that about $10T worth of debt has accumulated since the pandemic.

- The national debt is likely to exceed $50T by the end of the decade if nothing substantial is done.

- We are politically agnostic. Our sole job is to help investors by being objective.

- Many federal programs passed by the Biden administration are costing more than expected. Here are two examples:

- The Inflation Reduction Act of 2022 was supposed to cost about $400B over 10 years. The reality is that it may cost more than $1T. The government simply underestimated the generosity of energy tax credits in the act.

- The Employee Retention Credit was supposed to cost about $55B. It has already cost $230B. Recently, the IRS froze the program to stop fraud.

- Estimates are that the Federal government will be paying over $10T in interest over the next decade.

- For the first 11 months of the fiscal year, the federal deficit stands at $1.5T, a 61% increase over the same period last year.

- The U.S. national debt equals over $254,000 per taxpayer.

- In addition to the national debt, the government has unfunded liabilities. These liabilities now total over $193T. This equates to over $577,000 per U.S. citizen.

- Prudent investors are concerned and are taking into account the rising national debt in their allocation.

- Momo gurus have convinced the momo crowd that the national debt and unfunded liabilities do not matter. Momo gurus keep urging their followers to ignore the debt and buy stocks.

- Today is the second day of the Fed meeting.

- The Fed will announce its rate decision at 2pm ET.

- Powell’s press conference is at 2:30pm ET.

- The consensus is no rate hike but a hawkish statement.

- In The Arora Report analysis, the most important item that investors need to pay attention to is the dot plot. Please click here for a chart of the prior dot plot. For details, please see yesterday’s Morning Capsule.

- The momo crowd is buying stocks in the early trade on hope strategy.

- The narrative from momo gurus is that the stock market will rocket up after the Fed announcement. Even though momo gurus have been consistently wrong, prudent investors pay attention to momo gurus’ narrative because they have a large following, and the momo crowd is often in control of the stock market in the short term.

- As an actionable item, the sum total of the foregoing is in the protection band, which strikes the optimum balance between various crosscurrents. Please scroll down to see the protection band.

Magnificent Seven Money Flows In the early trade, money flows are positive in Apple Inc (NASDAQ: AAPL), Amazon.com, Inc. (NASDAQ: AMZN), Alphabet Inc Class C (NASDAQ: GOOG), Meta Platforms Inc (NASDAQ: META), Microsoft Corp (NASDAQ: MSFT), NVIDIA Corp (NASDAQ: NVDA), and Tesla Inc (NASDAQ: TSLA).

In the early trade, money flows are mixed in SPDR S&P 500 ETF Trust (ARCA:SPY) and Invesco QQQ Trust Series 1 (NASDAQ: QQQ).

Momo Crowd And Smart Money In Stocks The momo crowd is buying stocks in the early trade. Smart money is