Benzinga - Credit card debt hit a record $1 trillion in America. The average household carries $10,000 on their card - another record

It’s nearly impossible to build wealth when you’re paying 20% interest every month.

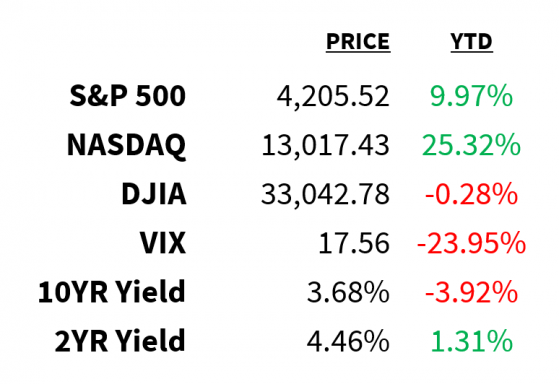

Market

Prices as of 4 pm EST, 5/30/23

Macro Today, the House of Representatives will vote on the debt limit deal.

- Both President Biden and House Speaker McCarthy are confident they have enough votes to pass it.

- The latter, however, faces a small cohort of Republicans who would see him ousted from his position.

- According to the Congressional Budget Office (CBO), the deal would trim government spending by $1.5 trillion over the next decade.

- The bulk of those reductions come in the form of discretionary spending cuts.

US home prices increased for the second straight month as the Case-Shiller National Home Price Index rose 0.4% in March.

- All 20 cities tracked by the index showed price gains.

- This reflects the lack of supply being faced by homebuyers as owners remain reluctant to part with low mortgage rates.

- On a year-over-year basis, prices increased by 0.7%–the smallest annual gain since May 2012.

The Conference Board’s index of consumer confidence in April dipped to its lowest since November.

- Both current and future expectations declined, as did consumers’ assessment of current employment conditions.

- In fact, the labor market differential—which measures those who say jobs are “plentiful” vs. those who say they are “hard to get”—fell to its lowest in 2 years.

- This could foreshadow a slowdown in May’s jobs gains (NFP data due Friday).

- On the other hand, consumer appetite for buying big-ticket items (cars, homes, major appliances, etc) increased, suggesting a solid spending outlook.

Stocks Nvidia became the first-ever chipmaker to cross the $1 trillion mark yesterday, albeit briefly.

- Semiconductor stocks are enjoying their best monthly performance in over 20 years thanks to the hype around AI.

- A group of AI executives, however, may be pouring cold water on the market’s excitement.

- Over 350 AI professionals—including Sam Altman and the “godfathers” of AI—signed a one-sentence statement published by the Center for AI Safety:

Mitigating the risk of extinction from AI should be a global priority alongside other societal-scale risks such as pandemics and nuclear war.

If you thought layoffs were over, think again.

- Goldman Sachs is considering its third round of job cuts in less than a year amid a slowdown in dealmaking that has hurt revenue.

- The move would affect around 250 employees (including senior staff) and follows a 3,200 headcount reduction in January.

- Morgan Stanley, meanwhile, is currently carrying out a 3,000-job disappearing act of its own over the quarter.

In yesterday’s note, we pointed out the (extremely) narrow breadth beneath the surface of the market’s YTD rally.

- As we wrote then, it’s not necessarily all bad news from here.

- According to BMO Capital, the S&P has returned an average of 6.7% in the subsequent 6 months after outperformance by the market’s largest 5 stocks.

- Out of 12 periods of similarly narrow breadth, BMO found that the index has only gone on to produce negative returns just one time.

BMO Capital Markets

Energy When US lawmakers vote on the debt-limit deal today, they’ll also be voting on fast-tracking the Mountain Valley Pipeline.

- As part of the deal, permits for the West Virginia natural gas pipeline would be expedited and environmental reviews curtailed.

- The $6.6 billion pipeline is near completion but has faced several years of legal delays.

- Pipeline proponents say the project is vital to US domestic energy security while critics argue it would undermine the country’s transition away from fossil fuels and harm marginalized communities.

Earning s Yesterday’s highlights:

Ambarella: (NASDAQ: AMBA) $-0.15 EPS (vs. $0.20 expected), $62.14 billion in sales (vs. $61.99B expected).

- Not all chipmaker outlooks can be as bright as Nvidia’s.

- The company guided Q2 revenue between $60-64 million, short of analysts’ forecast of $66.9 million.

- According to CEO Fermi Wang, however, AI is in focus: “We are taking our inference AI strategy to the next level”.

What we’re watching today:

- Salesforce (NYSE: CRM)

- Crowdstrike (NASDAQ: CRWD)

- Veeva Systems (NYSE: VEEV)

- NetApp (NASDAQ: NTAP)

- Okta (NASDAQ: OKTA)

- Chewy (NYSE: CHWY)

- Pure Storage (NYSE: PSTG)

- Donaldson Company (NYSE: DCI)

- CAE Inc (NYSE: CAE)

- Advanced Auto Parts (NYSE: AAP)

- Descartes Systems Group (NASDAQ: DSGX)

- C3.Ai (NYSE: AI)

- Nordstrom (NYSE: JWN)

Top Headlines

- Inflation drivers: According to the San Francisco Fed, rapid wage growth has not significantly contributed to inflation.

- Twitter value: Fidelity says Twitter is now worth just 33% of Elon Musk’s purchase price.

- Credit card overload: By some measures, credit card debt across households in the US has reached $1 trillion.

- Fed takes: Cleveland Fed president Loretta Mester says there’s no “compelling” reason to wait before hiking interest rates again.

- Contra-indicator: Cramer says the following industries are losers, act accordingly: energy, utilities, healthcare, real estate, staples, materials, industrials, and banks.

- China recovery: Factory activity in China contracted for the second consecutive month while growth in services slowed.

- Dimon warning: JPMorgan CEO Jamie Dimon has warned that uncertainty caused by the Chinese government could negatively impact consumer confidence.

- Treasuries demand: As the Fed has been raising rates, US households have been big buyers of US Treasuries.

Crypto

Prices as of 4 pm EST, 5/30/23

- Settlement: A former Coinbase (NASDAQ: COIN) manager settled insider trading claims with the SEC.

- Coinbase plea: CEO Brian Armstrong said restrictive rules in the US will drive innovation offshore to China.

- Crypto legislation: Two new crypto-focused bills addressing CBDCs and dark web drug trafficking have been introduced to Washington.

- Regulatory collab: Hong Kong and UAE are collaborating on regulation to attract global crypto companies.

- Pi Network: A crypto app with 45 million users is launching a new social media app to rival Twitter.

Deals

- Approved: Seagen stockholders voted to approve an acquisition by Pfizer for $229 per share in cash.

- VC funding: Pear VC, an early backer of DoorDash, has raised $432 million for a new early-stage investment fund.

- M&A expansion: Japanese Daiwa Securities plans to increase its M&A advisory revenue by 50% by expanding its presence with a focus on the US.

- Sweetener: Glencore is preparing to increase its bid for Teck Resources to get past the current deadlock.

- AI positioning: Chip designer Arm Ltd is looking to position itself as an AI player ahead of its upcoming IPO.

Meme Of The Day

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga