Benzinga - Good Morning Everyone!

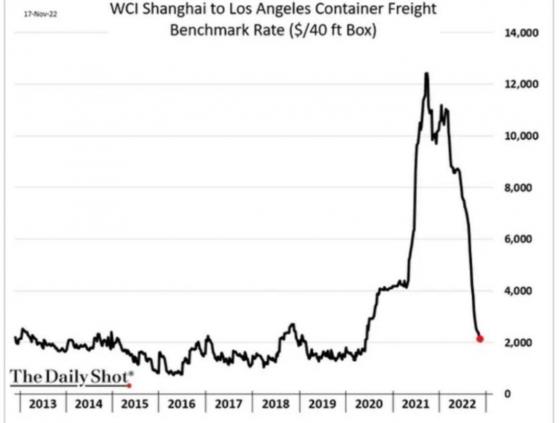

Is inflation canceled? Container shipping costs are back to pre-pandemic levels.

Prices as of 4 pm ET, 11/21/22; % YTD

MARKET UPDATE Fed talk

- 11 am - Mester

- 2:15 pm - George

- 2:45 pm - Bullard

Tomorrow = big data day

- Building permits, Durable Goods, Initial Jobless, S&P Global Flash PMIs, New Home Sales, Consumer Sentiment, EIA stocks change, and FOMC minutes

Q3 earnings update

- 94% of S&P 500 reported

- Overall EPS growth 2.2% - lowest growth in 2 years

Earnings outlook

- Analysts continue cutting EPS estimates

- But sales estimates remain resilient

- Long way to go to get through earnings recession

China lockdowns surge

- 27,307 new cases reported yesterday (just shy of daily record)

- Guangzhou (manufacturing hub) at epicenter of current wave

-

Lockdowns affecting ~20% of China’s total economic output

- 15.6% last week

- Goldman’s Effective Lockdown Index:

Crude $81.5 +1.6%

- Prices drop on reports OPEC considering production output increase

- Losses pared after Saudis deny report

-

Effects of lower prices

- Suggests weaker global demand, increased recessionary worries

- But also ease inflationary forces, support less aggressive monetary policy

CRYPTO UPDATE Grayscale refuses to share proof of reserves

- Cites “security concerns”

-

Shares of Grayscale Bitcoin Trust (OTC: GBTC) trading at deep discount

- As low as 50% yesterday

Genesis liquidity problems

- Seeking to raise at least $1 billion fresh capital

- Sought funding from Binance, Apollo Global

- If unsuccessful bankruptcy likely

Important: Grayscale and Genesis are both Digital Currency Group companies…

Digital asset flows

- Short investment products responsible for 75% of inflows last week

-

Bitcoin (CRYPTO: BTC) inflows of $14 million

- After short products, net outflows $4.3 million

- Short Ethereum (CRYPTO: ETH) products record inflows of $14 million

- Total AUM at lowest in 2 years

- Altcoins saw broad outlows

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga