Proactive Investors - Bitcoin may be straddling 30k, but Ethereum (ETH) hodlers have other worries on their minds with the Shanghai hard fork upgrade due to take place in the latter hours of this evening (Wednesday, April 12 for retrospective readers).

While hype and anticipation for Shanghai, which is expected to go live at epoch 194,048 on the Ethereum blockchain, or just before 10.30pm UTC (11.30pm BST/8.30pm GMT-4), is not as large or headline-grabbing as last year's Merge, the stakes are far higher… literally.

The Shanghai hard fork is part of a major shift from Ethereum’s transition from proof of work (PoW) consensus to proof of stake (PoS). Yes, The Merge was the official transitory moment, but it was only one piece of the puzzle.

For the uninitiated, the Shanghai upgrade will allow people to unlock their “staked” ether coins from hibernation. ETH holders were able to stake their coins prior to last year’s switch to proof of stake (PoS) consensus as a way to help with the upgrade and earn yield as compensation.

Post-Shanghai, anyone will be free to stake and unstake at their whimsy, thus making the staking protocol fully operational.

It gets very complex very easily, but the rub is: There is approximately US$31bn worth of currently staked ether coins poised to dilute the market, a bit like a central bank money printing machine but for magic internet beans.

For context, the current ETH market capitalisation is US$225.4bn, so staked ETH comprises around 14% of supply, meaning as much as 14% of ETH supply is about to dilute the market.

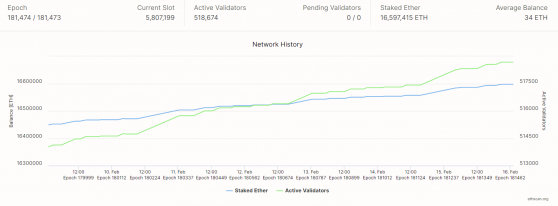

There are over 500,000 active ETH validators – Source: ethscan.org

It makes for scary headlines, but in reality, Ethereum’s unstaking mechanism can only process so much at any one time, thus the process is likely to take weeks if not months.

Furthermore, CryptoQuant pointed out in early March that 60% of staked ETH was below the realised price i.e. they would be selling at a loss.

Although ETH’s spot price is around 13% higher since then, it is likely that around half of staked ETH would be a loss maker if sold today.

2 Reasons we argue why ETH selling pressure will be low after the Shanghai Upgrade???????? 1/4 pic.twitter.com/bljiBS574Q

— CryptoQuant.com (@cryptoquant_com) March 2, 2023

Technical reasons aside, there are risk factors in the form of market sentiment.

Crypto is in a vastly different place now than it was in 2020 when stakers began staking with a view of being in it for the long run.

The catastrophe that was 2022 soured the mood for a large chunk of the market, NFTs – one of the Ethereum blockchain’s mainstays – have all but died out, and crypto traders are increasingly pivoting to the bitcoin safety net.

Capitulation among newly liberated ETH stakers is a valid threat.

Furthermore, Ethereum’s previous upgrade, the massively hyped Merge, preempted a 30% crash in ETH’s market value; not exactly a good omen for Shanghai.

For those waiting with bated breath, there are numerous watching parties tracking the Shanghai hard fork as it happens. You can join the official Ethereum watch party below.

Read more on Proactive Investors UK