Proactive Investors - What is crypto staking?

Staking is an essential part of how cryptocurrency and blockchain networks operate, but to understand the importance of staking, we need to back up a bit.

Blockchain networks are the conduit over which every cryptocurrency, whether that’s bitcoin, ether, Dogecoin or Dogelon Mars, move between accounts.

A blockchain network is essentially a decentralised Excel spreadsheet hosted by thousands of computers globally, so to facilitate transactions, a form of consensus among these computers is needed.

Bitcoin uses the OG of consensus protocols: Proof-of-work. Under proof-of-work (PoW), bitcoin miners compete to secure blocks of transactions by completing difficult mathematical equations.

The winning miner receives a reward in the form of freshly minted bitcoins (currently 6.25 BTC per block, halved every four years).

These rewards encourage miners to act in good faith. If a miner attempts to corrupt the network, they’ll be struck off, losing tonnes of rewards in the process.

Once a block of transactions is validated by a miner, it gets added to that decentralised spreadsheet.

As the cryptocurrency sector evolved, competing blockchain networks needed to find ways of overcoming PoW’s pitfalls: It’s extremely energy intensive, slow, and has a miserable transaction throughput.

Enter Proof-of-stake

Just like PoW, proof-of-stake (PoW) is a way of creating network consensus in a decentralised network, but the way it operates is considerably different.

As mentioned above, PoW is done by ‘mining’ for transactions by completing mathematical equations. These equations require an insane amount of energy to process- Bitcoin mining uses more energy per year than the entire country of Argentina.

Bitcoin mining farms can be as big as small towns!

Bitcoin’s energy intensity, while eye-watering, is also what makes it so secure. If any old Joe and his £200 Dell could do it, there would be massive problems with bad-faith actors.

Proof-of-stake, on the other hand, can be performed on a smartphone; it requires barely any computing power.

So it must be totally insecure right? Not necessarily.

Instead of computing power, PoS validators are required to ‘stake’ a certain amount of tokens to qualify as a validator and earn rewards, depending on the network’s requirements.

For instance, when Ethereum moved from PoW to PoS in 2022, it required a minimal stake of 32 ETH (over US$53,000 at today’s rates).

Under the PoS system, a validator will be fined if it acts in bad faith, thus network security is achieved.

Proof-of-stake criticisms: Ethereum case study

Proof-of-stake has been criticised as being anti-democratic, moving the nexus of power of the underlying blockchain to the richest player in the room, so to speak.

Ethereum became embroiled in a centralisation debate following its move to PoS in September 2022 when it was discovered that a single entity, Lido DAO, controlled up to 30% of the network.

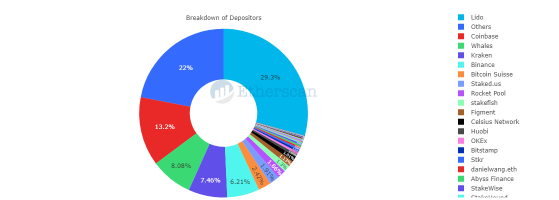

‘Whales’ refers to individual wallets with large sums of staked ETH – Source: etherscan.io

As of today, over 56% of Ethereum’s staking power is controlled by just five entities: Lido DAO, Coinbase (NASDAQ:COIN), Kraken and Binance, the latter three of which are major centralised cryptocurrency exchanges.

Now that Revolut has opened the doors to ETH staking through its app, we could see the UK-based fintech start-up on the pie chart in due course.

While at face value this fares terribly for Ethereum’s decentralisation, the story is a bit more complex than that.

Lido, Coinbase, Kraken et al act as staking ‘pools’ comprising thousands of individual ‘delegators’.

Pools work by allowing anyone to join them with as few or as many tokens as they want and sharing the yielding rewards accordingly.

If Coinbase, for instance, starts to act in bad faith, delegators can act with their wallets and join another pool instead.

Plus, bitcoin’s proof-of-work method has hardly escaped scrutiny either; only five mining pools control a whopping 86% of network hashing power.

Bitcoin mining pools also consist of thousands of individual constituents – Source: blockchain.com

Both PoW and PoS have their merits, and the debate will surely rage on as the cryptocurrency sector matures.

Read more on Proactive Investors UK