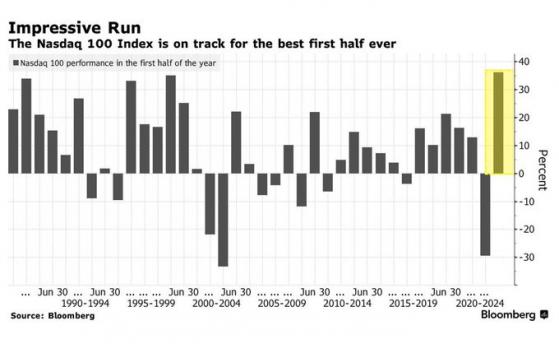

Benzinga - It’s been an amazing first half of the year for the NASDAQ. The NASDAQ 100 index is on track for best first half to a year ever.

Can the run continue?

Market

Prices as of 4 pm EST, 6/23/23

Macro Vladimir Putin had quite the weekend.

- On Friday, Yevgeny Prizogozhin, the leader of Russia’s private militia, released a video accusing Russia—among other things—of deliberately attacking his forces, known as Wagner Group.

- He also warned Putin that “25,000 of us” were marching on Moscow to “sort things out”, aka a mutiny was underway.

- After 24 hours of confusion and uprising, Putin struck a deal at the eleventh hour and avoided an attack.

- The rebellion represents the biggest challenge to Putin’s power in his nearly 25 years as Russia’s president.

For the first time since 2021, residential investment is projected to make a positive contribution to GDP in Q2.

- With new construction activity at its highest in more than a year, the 8-quarter contraction in residential investment appears to be over.

- The rise in activity is attributed to declining material costs, improving logistics, and limited availability of existing homes.

- Still posing risks, however, are rising interest rates and the possibility of a decline in construction as backlogs ease.

Business activity in the US grew at its slowest pace in 3 months in June.

- S&P Global’s flash purchasing managers index was mixed with services remaining strong while manufacturing contracted further.

- The latter fell to its lowest level of the year.

- Global surveys of manufacturing purchasing managers revealed a similar trend with factory activity declining as the effects of central banks’ tightening slow economic growth.

@macro84

Stocks Instability and higher rates are making it more expensive for small banks to hold on to depositors.

- As a result, Treasury Secretary Janet Yellen says she expects more consolidation in the sector.

- That means we could see a rise in bank mergers this year, especially among smaller players.

- The catalyst may be upcoming bank earnings, which are expected to be weak, particularly for those with heavy exposure to office building loans.

Corporate defaults in the US have totaled 41 this year.

- That’s more than twice as many defaults as in the same period last year.

- Low-rated companies are still finding ways to borrow money, however.

- So far this year, 62% of junk bonds issued by companies have been secured—i.e., fully collateralized—the highest percentage since at least 2005.

Goldman Sachs expects emerging market stock capitalization to become larger than that of the US by 2030.

- The bank predicts EM’s share of the global equity market will rise to 35% in 2030, 47% in 2050, and 55% in 2075.

- The current share is ~27%.

- The United States’ share, meanwhile, is expected to decline from 42% in 2022 to 35% in 2030, 27% in 2050, and just 22% in 2075.

Goldman Sachs

Energy US oil & gas activity has fallen to a standstill.

- A Dallas Fed survey of ~150 US O&G companies posted a zero for business activity growth in Q2.

- That’s the lowest since 2020 (chart).

- Data on Friday also showed rig counts in the US dropped for the 8th consecutive week.

Financial Times

Earnings

Friday’s highlights:

CarMax (NYSE: KMX): $1.44 EPS (vs. $0.79 expected), $7.69 billion in sales (vs. $7.49B expected).

- Despite a 17% YoY drop in revenue, the used-car seller topped estimates thanks to cost-saving measures like pausing buybacks, lowering headcounts, and cutting ad spend.

- Selling, general and administrative (SG&A) expenses fell 5.7% and have posted YoY declines in back-to-back quarters.

What we’re watching today:

- Carnival (NYSE: CCL)

Top Headlines

- Bearish talk: Wall Street’s biggest bear, Mike Wilson, says stock risks have rarely been higher.

- Bullish actions: Investors, meanwhile, are buying more bullish call options on chip stocks than ever before.

- Oil demand: OPEC predicts global oil demand will reach 110 million bpd by 2045, a 23% increase in the world’s energy demand.

- Job cuts: Goldman Sachs is cutting approximately 125 managing directors worldwide as part of a cost-saving initiative.

- Last mile: Amazon is launching a local business delivery network across the US to deliver its packages.

- Google games: YouTube is internally testing a new product called Playables that would let users play and share online games.

- Weak consumer spending: China’s recovery is losing momentum as consumers spend less on travel, cars, and homes.

- Panama Canal: A severe drought at the Panama Canal is jeopardizing a shipping route through which 40% of all US container traffic flows.

Week Ahead

- Monday: Dallas Fed Manufacturing Index

- Tuesday: Durable goods orders, Redbook, S&P/Case-Shiller Home Price Index, FHFA House Price Index, CB Consumer Confidence, New home sales, Richmond Fed Manufacturing Index, Dallas Fed Services Index

-

Wednesday: Goods trade balance, Retail inventories, Wholesale inventories, EIA crude oil inventories, Bank stress test

- Fed talk: Powell

-

Thursday: GDP Price Index, GDP Deflator, Initial jobless claims, Pending home sales, EIA natural gas inventories

- Fed talk: Powell, Bostic

- Friday: Personal income/spending, PCE prices, Chicago PMI, University of Michigan Consumer Sentiment

Crypto

Prices as of 4 pm EST, 6/23/23

- Crypto side door: Traders are using “digital residency” in a small Pacific island nation as a side door into crypto.

- Coinbase win: The US Supreme Court upheld Coinbase’s ability to use arbitration to handle customer and employee disputes in a 5-4 ruling.

- BITO inflows: ProShares’ Bitcoin Futures ETF (BITO) saw its largest weekly inflow in over a year.

- Leveraged ETF: The first leveraged Bitcoin futures ETF is launching tomorrow courtesy of Volatility Shares.

- Coin Services: JPMorgan completed its first blockchain transaction for corporate clients in Europe using its own token.

Deals

- Automation: IBM is in talks to acquire software company Apptio for around $4.5 to $5 billion.

- Rocket raise: SpaceX is looking to raise its valuation to $150 billion by offering insider shares at $81 apiece.

- PE dealmaking: Private equity deal volumes fell to a 4-year low due to high interest rates, recession fears, and weak corporate earnings.

- Semis loan: An Apollo-led group is lending up to $2 billion in private financing to semiconductor firm Wolfspeed for its US expansion.

- Groceries merger: JD.com plans to merge its 7Fresh supermarket chain with other online services to create an independent unit called Innovative Retail.

Meme Of The Day

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga